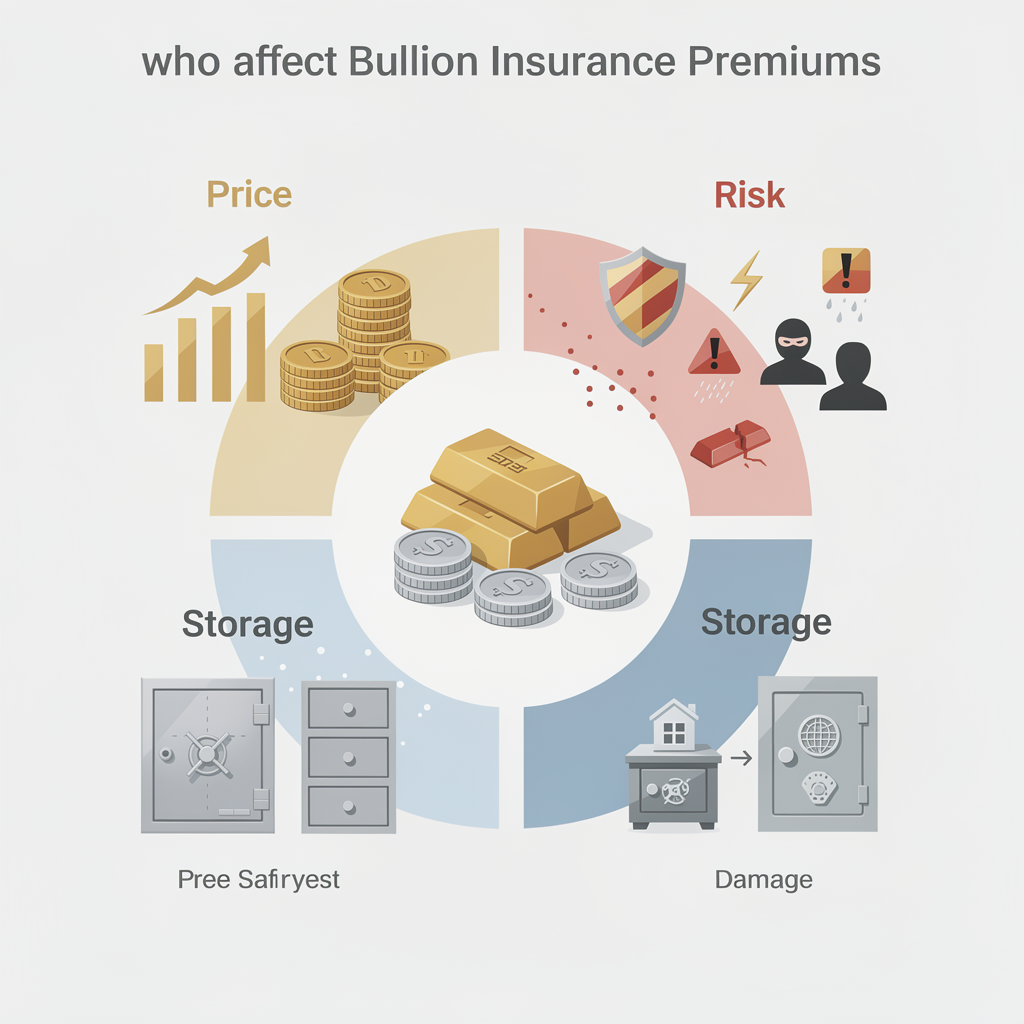

What affects bullion insurance premiums? A quick guide to price, risk, and storage

I learned something memorable not from a textbook, but from standing beside a vault door as the price of gold flickered on the monitor. In that moment, the insurance quote whispering in my ear didn’t feel like a fixed fee at all—it moved with value, storage, and risk. If you hold bullion, you probably have a similar moment when you realize premiums aren’t just a line item you pay every year; they’re a dynamic signal about how your assets are protected, where they live, and how they travel.

The simple mistake is to treat bullion insurance as a single, static cost. In reality, the premium is pulled by several levers: the replacement value of your holdings (which tracks current metal prices), where the metal is stored (home vs a vault backed by major markets), whether and how transit is covered, and broader insurance-market conditions that shape risk pricing. The good news is you can influence most of these levers with practical choices. This quick guide sketches the terrain and offers steps you can take today to balance protection with cost.

What follows is not an abstract list of terms. It’s a practical look at the forces that push premiums higher or lower, and how you can navigate them as a bullion owner in 2025—when gold prices have remained elevated and custody options have become more standardized. Recent market dynamics and provider structures give us a clearer sense of where costs come from and where they’re headed. For context, consider that gold prices in 2025 remained a key driver of how much protection you need, while the insurance market faced its own pressures from catastrophe losses and underwriting discipline across major markets like Lloyd’s. (Reuters, 2025)

The storage environment matters too. Vault-based custody arrangements—often backed by Lloyd’s or similar markets—tend to bundle insurance into custody fees and typically offer more transparent terms than ad hoc home-storage arrangements. Platforms such as BullionStar and BullionVault illustrate how insured custody works in practice, while UK offerings from providers like OneGold show Lloyd’s-backed coverage extending to international holdings. (BullionStar, BullionVault, OneGold)

If you’re thinking about numismatic pieces or coins with a premium above metal content, expect items to influence how coverage is priced. Insurers commonly offer agreed-value or scheduled-item endorsements for collectibles, which can change the cost-and-coverage math, especially when new acquisitions are frequent. (Chubb – Your Collections)

With that frame in place, let’s pull back the curtain on the main drivers and translate them into actionable steps you can take.

What actually drives bullion insurance premiums

Replacement value versus metal content

- Premiums often follow replacement value, not just the raw melt or spot value. When gold and other metals surge, replacement costs to rebuild a portfolio can rise quickly, lifting premiums even if your metal quantity hasn’t changed. This connection between metal prices and coverage value is a core reason premiums move in ways that feel surprising unless you track price dynamics. (Reuters, 2025)

- If you declare a higher value for numismatic pieces, some policies will insure at the higher of metal content or declared value. It’s essential to understand how your policy handles declared or insured values to avoid gaps or overpayment. (Texas Bullion Depository)

Storage location and the backer of your coverage

- Vault storage with strong underwriting (often Lloyd’s-backed) tends to offer clearer, more scalable terms, especially for larger holdings. In practice, depository storage can simplify administration and stabilize premiums as holdings grow. (Texas Bullion Depository; Lloyd’s)

- Home storage can be viable but typically entails riders or specialized coverage for collectibles, which can add complexity and potentially higher per-item costs. (BullionVault; Chubb collectibles policies)

In-transit coverage and shipping risk

- Coverage during transit is a standard feature for many bullion programs, but terms vary. Transit insurance usually sits with the same or a companion insurer as vault coverage, helping to align risk across the movement of assets. Always confirm when coverage starts and ends during transfers. (BullionStar)

Security posture and storage quality

- The level of security—guards, vault reliability, access controls—feeds into risk assessments that insurers use. Higher-security setups typically command lower incremental premiums because the risk of loss or theft is reduced. (Lloyd’s market discussions; vault operators’ materials)

Market conditions and catastrophe exposure

- The broader insurance market, including catastrophe losses and the cost of capital, filters into the pricing of all insured lines. Even if bullion coverage is a niche product, it’s not immune to these macro trends. (Lloyd’s – 2025 market commentary)

Numismatic and specialty coverage

- For coin collections and other memorabilia with high premium values, insurers offer options like “Agreed Value” or scheduled coverage, which can alter premium structures. If you regularly acquire high-value pieces, these terms can be worth the extra cost for peace of mind. (Chubb; American Collectors Insurance)

Practical steps to manage premiums while staying protected

- Decide storage approach with price in mind:

- If you want straightforward protection for large holdings, vault/storage with Lloyd’s-backed coverage tends to be a clear path, with insurance embedded in custody fees. Compare options from providers like BullionStar and BullionVault. (BullionStar; BullionVault)

-

If you prefer home storage, prepare for additional riders or a specialized collectibles policy that covers storage and transit specifics. (Home-storage policies; collectors’ riders)

-

Clarify coverage on new acquisitions:

-

Ensure your policy automatically covers new items or has a simple process for adding them, especially if you regularly acquire coins or bars. Aggregated “automatic additions” features are common in collectors’ policies but verify the details. (Chubb; collectors’ policies)

-

Understand transit coverage explicitly:

-

When moving bullion, confirm who underwrites transit coverage, the coverage limits, and the exact start/end points of protection. This is often bundled but can vary by jurisdiction and platform. (BullionStar; platform disclosures)

-

Align with credible insurers and markets:

-

Favor policies backed by well-known markets like Lloyd’s and review the insurer’s financial strength and the specific terms on replacement value, declared value, and riders. (Lloyd’s; Texas Bullion Depository)

-

Monitor price movements and reflect them in insured values:

- As gold and silver prices move, the replacement-value component of your coverage will shift. Keep an eye on credible price benchmarks and adjust coverage accordingly to avoid underinsurance or overpaying. (Reuters, 2025)

Quick glossary for the curious reader

- Replacement value coverage: Pays to replace an item at new-for-old value, not merely the current market price. This matters when metals price spikes are fast. (Texas Bullion Depository)

- Agreed Value: A stated value the insurer agrees to pay for a collectible, preventing depreciation in a total loss. (Chubb)

- Riders/Endorsements: Add-ons that extend coverage to specific items or types of losses beyond the base policy. (Collectors’ policies)

Final thought to leave you pondering

As you map out how you protect bullion, ask yourself: would you rather chase a lower premium today with potential gaps tomorrow, or invest a bit more upfront in a protection that scales with the value and movement of your own assets—and what would that mean for your sense of security if prices swing suddenly? If the game changes with the price of metal, what stays constant about your protection—and what are you willing to adjust as a steward of your own holdings?

What actually drives bullion insurance premiums—and how you can steer them

I still remember standing beside the vault door, the monitor flickering with gold prices. The screen wasn’t just a finance tick; it was a reminder that protection costs move with value, risk, and where your metal lives. Bullion insurance isn’t a static fee. It’s a dynamic signal about how your assets are stored, how they travel, and how the insurance market prices risk in real time. If you hold bullion, you’ve already felt that tug—a rising price can lift your replacement-value coverage, and with it, your premiums.

Below is a practical map of what actually moves bullion insurance costs, followed by concrete steps you can take today to balance protection with price. I’ll weave in real-world examples and current market nuances to help you navigate with confidence.

The main levers replacement value and metal prices

- Replacement value vs. metal content. Most bullion policies aim to cover the replacement value: what it would cost to replace your holdings at new-for-old value, not just the melt or spot price. When gold and other metals surge, insurance affordability isn’t just about how much metal you own; it’s about how much it would cost to rebuild your portfolio. That connection between metal prices and coverage value has been highlighted by market signals in 2025.

- Recent market commentary notes gold price momentum supporting higher replacement values for insured holdings (Reuters, 2025).

- If you hold numismatic coins with substantial premiums above metal content, some policies insure at the higher of metal value or declared value, which can push premiums up as those declared values rise.

-

Source: Reed-through-the-years dynamics and industry discussions show this linkage is core to premium behavior in rising markets.

-

Price movement isn’t instantaneous, but it’s close. When precious-metal prices spike, insurers may adjust the baseline for new/renewed policies or for automatic replacement-value terms. The trend toward automatic, 100% replacement-value coverage in depositories amplifies this effect, because the insured value is explicit and rises with prices.

- Examples include vault operators offering Lloyd’s-backed replacement-value coverage for stored bullion as a standard feature in many depositories (Texas Bullion Depository) and vault overseers where storage fees include insurance.

-

See: Texas Bullion Depository and similar programs for explicit replacement-value structures.

-

What this means for affordability. If you’re not actively managing your insured value, rising commodity prices can quietly push premiums higher. The practical takeaway is not to fear the price increase, but to align the value basis with how you actually manage and store your metal.

Storage location and the insurer behind it

- Vault storage with strong underwriting. A vault backed by a reputable market (often Lloyd’s) tends to offer clearer, scalable terms, especially for larger holdings. This can stabilize premiums over time as your position grows and the insured value tracks the vault’s inventory. Vault-based programs often bundle insurance into custody fees, which simplifies budgeting and reduces gaps from separate riders.

- Providers like BullionStar and BullionVault illustrate how insured custody works in practice, with Lloyd’s backing in many locations. OneGold’s UK products also demonstrate Lloyd’s-backed coverage for international holdings.

-

Practical note: check whether transit coverage is included and who underwrites it, since movement between locations is part of the risk calculus.

-

Home storage and collectibles riders. If you choose to store at home, you’ll likely face additional riders or specialized collectible policies. These can be more complex and sometimes pricier per item, but they’re workable with the right insurer and endorsements (collectibles coverage, Agreed Value).

- Insurers known for collectibles coverage (including coins) often offer automatic additions for new items or adjustable values, but terms vary by policy and carrier.

-

Examples: collectors’ policies from major providers (Chubb, American Collectors Insurance) provide Agreed Value and scheduled-item endorsements.

-

Declaring new acquisitions matters. If you regularly add coins or bars, make sure your policy includes automatic coverage for new items or has a simple add-item process. This reduces the risk of gaps when you expand your collection.

Transit coverage and shipping risk

- In-transit coverage is common but not universal. Many bullion programs cover shipments, either via the vault operator or a partner insurer. Coverage timing and limits can differ by jurisdiction and platform, so it’s essential to confirm the exact terms: when protection starts and ends, and what events are covered (theft, loss, damage).

-

Practical references show that vault-insured transit coverage is a standard feature in many depository ecosystems (e.g., BullionStar).

-

Movement safety reduces overall cost pressure. When you can bundle asset storage and transit under the same insurer or program, risk aggregation can translate to lower incremental costs compared with separate, ad hoc transit insurance.

Security posture and storage quality

- The level of physical security and operational controls affects risk assessments. Higher-security vaults, disciplined access controls, and robust audit procedures reduce the probability of loss, which insurers reflect in pricing. In a market shaped by Lloyd’s discipline and catastrophe risk, the quality of storage has become a major premium lever.

Market context: broader insurance pricing influences bullion premiums

- The general insurance market’s condition—catastrophe losses, cost of capital, and underwriting cycles—shapes bullion coverage costs even though bullion is a niche line. Lloyd’s market commentary and half-year results in 2025 point to disciplined underwriting amid higher catastrophe activity, which can indirectly keep upward pressure on premiums across specialty lines like bullion insurance.

- This is the same ecosystem that underwrites many vault-based protections (Lloyd’s-backed programs) and affects the affordability of storage and transit coverages.

Practical steps you can take to manage premiums today

- Decide storage approach with price sensitivity in mind:

- Vault/storage with Lloyd’s-backed coverage tends to offer straightforward protection for large holdings, with insurance embedded in custody fees. If you want transparent protection for growing positions, this is a practical path (BullionStar, BullionVault).

-

Home storage can work but may require a collectibles rider or an entirely separate policy; budget for potential higher per-item costs and more complex administration.

-

Ensure automatic coverage for new acquisitions:

-

If you regularly add coins or bars, prioritize policies that automatically cover new items or offer a simple enrollment process for additions. Agreed Value or scheduled-endorsement options can be helpful for high-value pieces (Chubb, American Collectors Insurance).

-

Confirm transit coverage specifics:

-

When moving bullion, verify who underwrites transit protection, coverage limits, and the exact protection window. In many platforms, transit coverage is bundled with vault insurance, but terms vary by jurisdiction.

-

Align with credible insurers and markets:

-

Favor policies backed by stable markets like Lloyd’s and verify financial strength and exact terms on replacement value, declared values, and riders. This alignment reduces the risk of coverage confusion when prices swing.

-

Monitor metal-price movements and reflect them in insured values:

- As gold and silver prices move, the replacement-value component of your coverage will shift. Track credible price benchmarks and adjust coverage if needed to avoid underinsurance or unnecessary overpayment. Market updates in 2025 corroborate the ongoing link between metal price levels and insurance needs.

-

See: Reuters coverage of gold price momentum in 2025 (Reuters).

-

Practical blog-ready takeaways:

- Replacement value tracks metal prices; keep your insured value aligned with current price levels to avoid sudden premium jumps.

- Use credible insurers and backstops (Lloyd’s or equivalent) and verify the specifics of replacement vs declared values and riders.

- For new acquisitions, look for automatic additions or easy policy updates to prevent gaps.

Quick glossary for the curious reader

- Replacement value coverage: Pays to replace an item at new-for-old value, not merely the current market price. This matters when metals price spikes are fast. (Texas Bullion Depository)

- Agreed Value: A stated value the insurer agrees to pay for a collectible, preventing depreciation in a total loss. (Chubb)

- Riders/Endorsements: Add-ons that extend coverage to specific items or types of losses beyond the base policy. (Collectors’ policies)

Try this directly now: a concise, actionable plan

- Step 1: Inventory and value. Create or update a secure inventory, listing each bullion item with its current replacement value (not just melt value). Note which items are numismatic and carry premium above metal content.

- Step 2: Choose storage approach. If you have substantial holdings, compare vault-based options with Lloyd’s-backed coverage (BullionStar, BullionVault). If you prefer home storage, budget for a collectibles rider and a clear coverage scope.

- Step 3: Confirm coverage scope. For any plan, verify whether the policy covers new acquisitions automatically and whether transit coverage is included. If not, ask for a rider or a package that includes shipping.

- Step 4: Review transit terms. If you anticipate transfers (to a vault, dealer, or new storage location), ensure transit protection is active and underwritten by a reputable carrier.

- Step 5: Set a price-monitoring cadence. Establish a quarterly check to compare replacement-value against current metal prices from reputable sources (e.g., Reuters price reports; major market benchmarks).

- Step 6: Schedule a periodic policy review. Annually revisit your declared values, coverage limits, and riders to ensure alignment with your holdings and risk tolerance.

Final thought to leave you pondering

As you map out how you protect bullion, ask yourself: would you rather chase a lower premium today with potential gaps tomorrow, or invest a bit more upfront in a protection that scales with the value and movement of your own assets—and what would that mean for your sense of security if prices swing suddenly? If the game changes with metal prices, what remains constant about your protection—and what are you willing to adjust as a steward of your own holdings?

- Notes and sources referenced in this discussion reflect industry developments and program details up to December 31, 2025. See market reporting and issuer disclosures from sources including Reuters (gold price momentum in 2025), Lloyd’s market commentary, and program specifics from Texas Bullion Depository, BullionStar, BullionVault, OneGold, and collectibles insurers such as Chubb and American Collectors Insurance for further context and verification.

A dynamic kind of protection lessons from standing by the vault door

I still remember standing beside the vault door, the monitor flickering with gold prices. It wasn’t just a market moment; it felt like a reminder that protection costs move with value, risk, and where your metal lives. The hard truth is simple: bullion insurance isn’t a fixed fee. It’s a living signal about how you store, move, and guard your assets, and how the insurance market prices that risk in real time.

In 2025, with elevated metal prices and a maturing custody landscape, that signal is clearer than ever. Replacement value tracks market swings; storage choices determine the layers insurers will quote; and a moment of transit can sharpen or soften an entire policy profile. Let this piece be less a list of terms and more a map of how to steer that signal toward protection that fits your reality.

What actually drives bullion insurance premiums (and how to read the dial)

- Replacement value vs metal content: Premiums follow the cost to replace your holdings, not just the physical metal you hold. When prices rise fast, the cost to rebuild can jump even if your quantity stays steady. If you own coins with premiums above metal content, some policies will price coverage at the higher of metal value or declared value, which can raise costs as those declarations grow.

- Storage location and the insurer backing it: Vault storage with strong underwriting, often Lloyds backed, tends to offer clearer, scalable terms and can bundle insurance into custody fees for easier budgeting. Home storage can work too, but riders or specialty collectibles coverage may be necessary and can add complexity.

- In transit coverage: Coverage during movement is common but varies by program. Know when protection starts and ends during transfers and who underwrites it.

- Security posture and storage quality: Higher security reduces risk and can translate into more favorable pricing, especially in markets known for disciplined underwriting.

- Market conditions and catastrophe exposure: The broader insurance environment, including catastrophe losses and capital costs, threads into every specialized line, bullion included. In practical terms, this means even niche coverages feel the tempo of wider markets.

- Numismatic and specialty coverage: For collectible pieces, agreed value or scheduled endorsements can alter both price and protection. If you frequently acquire high-value pieces, these terms may be worth the extra cost for peace of mind.

Practical steps you can take today to balance protection and price

- Decide storage approach with price in mind:

- If your goal is straightforward protection for large holdings, vault or depository storage with Lloyds-backed coverage can simplify budgeting, since insurance is embedded in custody fees. Compare options from established players like BullionStar and BullionVault, and consider how transit coverage is handled.

- If home storage is your path, plan for collectible riders or a dedicated collectibles policy that clearly covers storage and transit specifics. Be mindful that per-item costs can rise, and administration may be more involved.

- Clarify coverage for new acquisitions: Ensure your policy automatically covers new items or has a simple process for adding them, especially if you frequently expand your collection. Automatic additions or easy endorsements can prevent gaps.

- Understand transit coverage explicitly: When moving bullion, confirm who underwrites transit protection, the coverage limits, and the exact protection window. Terms can differ by jurisdiction and platform.

- Align with credible insurers and markets: Favor policies backed by established markets and verify the terms on replacement value, declared values, and riders. This alignment helps avoid misalignments when prices swing.

- Monitor price movements and reflect them in insured values: As metal prices move, the replacement-value component will shift. Track credible benchmarks and adjust coverage as needed to avoid underinsurance or overpayment. The link between metal price levels and insurance needs has stood out in market discussions and reports through 2025.

- Build a practical cadence:

- Create or update a secure inventory with current replacement values for each item, noting which pieces carry numismatic premiums.

- Regularly compare storage options and confirm coverage scope for acquisitions and transit.

- Schedule an annual policy review to ensure declared values, limits, and riders still mirror your holdings and risk tolerance.

A personal, reflective note

Weighing price versus protection is a human act as much as a financial one. Would you rather chase a lower premium today and risk tomorrow, or invest a bit more upfront in protection that scales with your assets as prices move? If metal prices swing, what stays constant about your protection—and what are you willing to adjust as a steward of your holdings?

Closing perspective and a gentle nudge to act

The right bullion insurance setup isn’t about chasing the smallest number on the quote sheet. It’s about aligning protection with how you store, move, and value your holdings. Start with a clear inventory, choose a storage path that fits your risk tolerance, and ensure your policy smoothly covers new acquisitions and transit. If you take those steps, you’ll move from simply owning metal to safeguarding a living, evolving asset with a protection plan that actually matches the way you live with it.

What will you adjust first to harmonize protection with your evolving holdings—and how will you know you’ve found the balance that keeps you calm as markets shift?