The Quiet Edge in Retirement Portfolios – Should Bitcoin Be 1%?

Is Bitcoin the quiet hinge in a retirement plan—small in size, potentially large in impact?

That question gnaws at me whenever I sit with a long-term saver who’s staring down decades of inflation, withdrawals, and the slow drift of markets. I’ve watched a few conversations shift when we shifted from “Can we own Bitcoin?” to “How can we own Bitcoin in a controlled, purposeful way?” The tension isn’t about hype; it’s about whether a 1% to 2% tilt can meaningfully alter risk and resilience over a meaningful horizon.

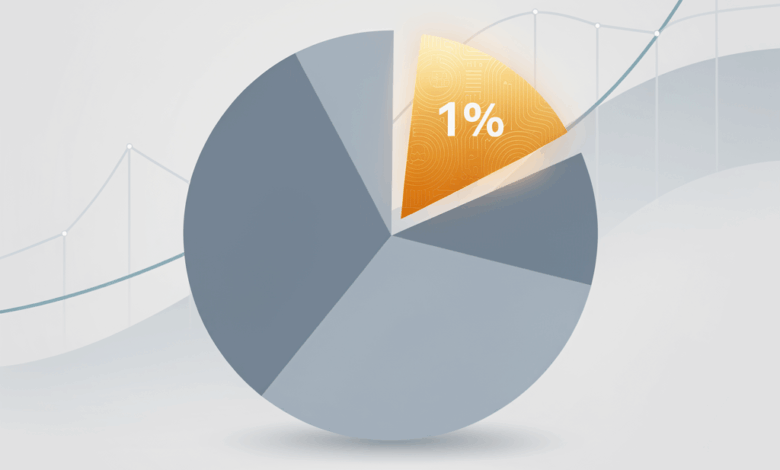

From another angle, Bitcoin has begun to look less like a speculative impulse and more like a macro asset that could interact with traditional markets during stress. In 2025, major institutions started to treat Bitcoin exposure as a legitimate, though still small, element of diversified portfolios. BlackRock, for example, signaled a conservative 1%–2% allocation to a Bitcoin-backed vehicle within model portfolios that permit alternative assets. The market has also shown that flows into Bitcoin exchange-traded products rise and fall with macro regimes, underscoring that the asset behaves like a risk-on/ risk-off indicator as much as a hedge (Coindesk, 2025; Reuters, 2025).

Why should a retirement plan care about this shift? Because the horizon matters. Retirement investing is dominated by long timeframes, sequence-of-returns risk, and the need for capital preservation in the early decades and growth potential later on. A small, disciplined exposure to a non-traditional asset can, in theory, offer a different kind of diversification—one that may respond to different macro drivers than stocks and bonds do. But the key word is disciplined: not a flyer, not a fantasy, but a measurable, governed allocation with clear guardrails.

What you gain from reading this piece is not a prophecy about Bitcoin’s price, but a practical, three-part way to think about including it in a retirement plan without turning the plan into a roller coaster:

- A risk-budgeting mindset that keeps the overall plan intact even if crypto experiences a downturn. The aim is long-run resilience, not short-run excitement. Recent market behavior underlines that Bitcoin’s correlations rise in stress periods, which matters for strategy design in retirement accounts (Coindesk, 2025; Reuters, 2025).

- A decision framework that helps you decide if, how, and when to add exposure, with a conservative starting point anchored around 1%–2% of the total portfolio. This aligns with mainstream institutional practice while leaving room for client-specific tailoring (BlackRock 1%–2% signal; adviser discussions cited in industry coverage).

- Practical considerations around custodial access, tax reporting, and governance—so you’re not choosing a vehicle in a vacuum but in a framework that fits a fiduciary or DIY approach.

How I’d approach this as a reader and practitioner alike is to begin with clarity on risk, then move toward a viable implementation, and finally build ongoing oversight that respects the long retirement horizon. Below is a concise way to frame this journey without pretending certainty where it doesn’t exist.

From a practical standpoint, here’s a natural progression you can picture—without needing to overhaul your entire plan:

- Understand your risk budget. If your portfolio is already sized for long-term withdrawal safety, a 1%–2% crypto sleeve could be a way to test the waters without destabilizing the core.

- Decide on the exposure vehicle. Institutional-grade options—such as regulated Bitcoin ETFs or trust-based products—offer familiar oversight, liquidity, and reporting paths that align with retirement accounts and taxable accounts alike. The landscape is evolving, but the mainstream trend favors accessible, regulated exposure rather than unregulated bets.

- Implement with guardrails. Define maximum drawdown tolerances, confirm tax reporting implications, and set review cadences (e.g., annual or semi-annual check-ins) so the allocation remains aligned with goals and risk tolerance over time.

Why this matters now: regulatory clarity is advancing in ways that reduce some of the prior policy ambiguity around crypto in retirement accounts. An executive order in early 2025 and a formal stablecoin framework in mid-2025 established a more predictable backdrop for institutions. This is not a green light for all-systems-go; it’s a signal that prudent, well-governed exposure can be contemplated within a broader, diversified plan (White House; GENIUS Act coverage; Reuters/Financial outlets cited in 2025 reports).

Tax and reporting realities also matter more than ever. The U.S. Treasury and IRS moved toward phased crypto tax reporting that nudges cost-basis tracking and transaction reporting toward greater clarity over the next couple of years. Brokers will begin reporting gross proceeds for 2025 sales via Form 1099-DA, with cost-basis reporting expanding for 2026–2027 for covered and noncovered securities. The practical upshot for retirement investors is a stronger need for careful record-keeping and awareness of how crypto activity flows into tax reporting, even when the asset sits in a tax-advantaged vehicle (IRS guidance; filing instructions, 2025–2027 outlook).

A few concrete touchpoints to keep in mind as you explore the idea:

- Institutional signals matter, but client-specific fit matters more. The 1%–2% allocation observed in large funds reflects a cautious, long-horizon posture—use it as a reference point, not a mandate. Some advisers discuss higher allocations in particular cases, but these views remain controversial and not widely adopted for retirement plans.

- Global and cross-border dynamics can shape plan design. Regulatory developments at the U.S. federal level reverberate through European and global asset-management practices, especially for multinational plans or institutions with global exposures (as discussed in coverage of regulatory responses and market implications).

- The path is not about price predictions; it’s about risk management over decades. If you view Bitcoin as a macro-asset with unique drivers, you’ll design a guardrail-based approach that protects the core of your plan while allowing a measured tilt toward crypto within a structured framework.

What would it look like to begin this journey in a way that feels responsible and doable? It starts with clarity, a simple framework, and a willingness to revisit the plan as markets and regulations evolve. If you’re a long-term investor, a fiduciary, or a DIY saver, the idea isn’t to chase the next big move but to decide whether a small, disciplined exposure could help you sleep a little easier at 3 a.m. knowing the horizon remains unchanged—and the guardrails are in place.

Is this the moment to reframe your retirement plan’s risk budget around a quiet, careful crypto sleeve? If you’re intrigued, we can map out a practical, step-by-step reflection that respects your goals, your constraints, and your personal comfort with risk. After all, the most powerful questions are often the simplest: what kind of edge do you want for the long run, and what would you be willing to change to protect it? What would you adjust if the map changes tomorrow?

Should Bitcoin Be the Quiet Hedge in a Retirement Plan?

I remember a client who kept staring at a chart of inflation and withdrawals, shoulders tense as if the numbers themselves were whispering, “be careful.” The question wasn’t whether Bitcoin could rise or fall; it was whether a small, disciplined exposure could help a long horizon sleep a little easier. The moment we shifted from asking, “Can we own Bitcoin?” to, “How can we own Bitcoin in a controlled, purposeful way?” something changed. This piece is for those long horizons—retirees in the making, planners, and curious DIY investors—who want a practical framework rather than a hype cycle.

A private prompt that becomes a public question

A few years back, the private question looked like a dare: if we put a sliver of crypto into a retirement sleeve, would the rest of the portfolio stay intact when markets wobble? The answer isn’t a crystal-clear forecast; it’s a risk-budget, a governance rulebook, and a handful of concrete steps you can take today. The core idea is simple in theory and hard in execution: a small, intentional crypto exposure within a diversified, long-horizon plan can potentially add resilience without turning the plan into a roller coaster.

From a whispered doubt to a practical framework

This is not a manifesto about price targets or sensational bets. It’s a decision-framing exercise shaped by recent regulatory clarity and growing institutional experience. In 2025, policymakers signaled a more predictable environment for digital assets, with executive focus and practical standards for stablecoins, custody, and market access. That backdrop matters because it shifts crypto from “the wild frontier” to a component that can be discussed with fiduciaries, plan sponsors, and individual savers (White House action in 2025; GENIUS Act developments; broader regulatory commentary).

There’s also growing institutional experimentation with a conservative footprint. BlackRock’s acknowledgment of Bitcoin exposure within model portfolios—roughly a 1%–2% sleeve when the plan permits alternative assets—offers a mainstream reference point. It’s not the rule for every saver, but it signals what disciplined, long-horizon thinking looks like (BlackRock 1%–2% signal; industry coverage). Flows into and out of Bitcoin-linked ETFs or trusts underscore that crypto is no longer a fringe asset class, but a measured, budgeted piece of diversified portfolios (IBIT and peers, with ongoing investor flows; Reuters/Coindesk coverage).

The mindset risk budgeting, not gambling

A long retirement horizon invites you to ask: where does risk come from, and how can a tiny tilt toward crypto affect that risk profile over decades?

- We’re thinking in terms of risk budgets. A 1%–2% exposure is not about chasing the next moon shot; it’s about potential diversification benefits that don’t derail the core of the plan during adverse markets. This aligns with mainstream practice in large institutions, while leaving room for client-specific tailoring (institutional signals + adviser perspectives).

- We treat Bitcoin more as a macro-asset than a pure hedge. The growing tendency to observe correlations with traditional markets during stress periods means you shouldn’t expect a smooth, independent ride. Instead, you design guardrails that respect those dynamics and aim for long-run resilience.

- We recognize the tax and reporting realities that quietly shape every decision. The 2025–2027 reporting trajectory is nudging investors toward better cost-basis tracking and transaction visibility, even when the crypto sits inside a tax-advantaged wrapper (IRS guidance and 1099-DA developments). This isn’t a sidebar—it’s part of how you stay compliant and organized over time.

With that in mind, here is a practical pathway you can adapt, starting today.

Practical path: step-by-step guide you can adapt now

1) Clarify your risk budget

– Start with your overall plan’s risk tolerance and withdrawal cadence. If you’re decades from retirement, a 1%–2% crypto sleeve may fit a growth-seeking, downside-conscious posture. If you’re closer to retirement, you may want a tighter cap and more frequent reviews.

– Set guardrails for how you react to drawdowns (e.g., no automatic add-on during a dip; only a quarterly review to consider rebalancing within the budgeted sleeve).

2) Decide on the exposure vehicle

– Favor regulated, transparent vehicles when the aim is retirement-plan compatibility: regulated Bitcoin ETFs or trust-based products, which offer clearer custody, liquidity, and tax reporting paths that align with retirement accounts and taxable accounts alike.

– If your plan sponsor provides a crypto option (or a fiduciary-approved vehicle), ensure it has robust governance, custody, and disclosure standards before entering.

– Keep the allocation path conservative even within available options; treat this as a long-horizon, low-visibility sleeve rather than a speculative bet.

3) Establish guardrails and governance

– Define a maximum drawdown tolerance for the sleeve and a cadence for review (annual or semi-annual checks are common).

– Document decision rules: who approves changes, what triggers a reevaluation, and how this interacts with other risk controls in the portfolio.

– Align with tax and reporting readiness: understand how crypto activity will appear in Form 1099-DA reporting for 2025, 2026, and beyond, even if the asset sits in a tax-advantaged wrapper (IRS guidance; 1099-DA developments).

4) Prepare for tax and reporting realities

– Track cost basis with clarity: 2025 brings broker reporting of gross proceeds for 2025 sales via Form 1099-DA, with cost-basis reporting expanding in 2026 and 2027 for covered/noncovered securities. This makes careful record-keeping essential, especially when mixing retirement accounts with taxable accounts (IRS guidance; planning implications).

– Understand wash-sale nuances: most crypto holdings are treated as property, not securities, so traditional wash-sale rules don’t automatically apply as they do for securities. This area remains evolving, and early preparation helps you avoid surprises as guidance tightens.

5) Implement with discipline

– Choose a starting point within the 1%–2% range, then test for a full year or two across different market regimes. If you’re tempted to go higher, anchor that decision in a formal review rather than emotion.

– Schedule annual reviews that consider macro regimes, plan performance, and personal circumstances. Treat the crypto sleeve as an ongoing experiment, not a one-off bet.

– Document lessons learned and adjust guardrails as your plan matures and as regulatory and market conditions shift.

6) Build awareness of the broader context

– Regulatory clarity matters. The evolving U.S. framework and stablecoin standards create a more predictable environment for institutions, which translates to more plan sponsors feeling comfortable offering crypto exposure with guardrails (Executive actions and GENIUS Act coverage; cross-border reflections).

– The macro linkages matter. Bitcoin’s price dynamics have shown meaningful sensitivity to macro regimes, which reinforces the need for a long-horizon, diversification-minded approach rather than a short-term trade (volatility observations; correlation patterns in stress periods).

A practical example to anchor the idea

Imagine a 40-year-old saver with a $1,000,000 portfolio and a 30-year horizon. They allocate 1.5% to a regulated Bitcoin ETF within a diversified sleeve. The goal isn’t to flip away from stocks or bonds; it’s to diversify within a risk budget that already accounts for withdrawal risk, inflation, and sequence of returns. The plan includes:

– A defined governance process with a quarterly review.

– A tax and reporting plan that tracks cost basis and informs 1099-DA-related disclosures.

– A plan sponsor that provides fiduciary oversight for crypto exposure with clear custodial arrangements and disclosures.

Over a 30-year horizon, the small tilt could behave differently in macro-stress environments, potentially adding a non-correlated driver to the portfolio while the rest of the assets follow traditional risk and return dynamics.

The question, then, isn’t whether Bitcoin will moon or crash, but whether a quiet, careful allocation can contribute to resilience without compromising the integrity of the plan. The numbers aren’t a touchdown—this is a long game with guardrails and governance baked in.

The broader takeaway: what this means for you

- The right Bitcoin exposure in retirement portfolios depends on your overall risk budget and your fiduciary or DIY posture. The 1%–2% range is a practical, widely discussed starting point that mirrors mainstream institutional thinking while still leaving room for personalization.

- The path forward is not price forecasting. It’s risk management, governance, and clear reporting. The regulatory and tax environments are shifting toward greater clarity, which supports careful inclusion—but only when you stay disciplined and well-documented.

- The question to carry forward is a simple one: what edge do you want for the long run, and what would you be willing to change to protect it? If you’re intrigued, we can map out a concrete, step-by-step plan that respects your goals, constraints, and comfort with risk.

Is this the moment to reframe your retirement plan’s risk budget around a quiet, careful crypto sleeve?

If you’d like, we can tailor this framework to your situation, work through a concrete starting allocation, and build a calendar for governance, reporting, and review. The most powerful questions are often the simplest: what kind of edge do you want for the long run, and what would you be willing to change to protect it? What would you adjust if the map changes tomorrow?

-

Additional Context: Bitcoin in Retirement Portfolios, Crypto Allocation for Long-Term Investors, regulatory developments in 2025, tax reporting shifts, and the practical realities of fiduciary governance are central to this discussion. The aim is to offer a disciplined, implementable approach rather than a speculative forecast. The horizon remains long, but the steps you take today—secure custody, clear guardrails, and accountable reporting—are the ones that shape tomorrow.

-

If you want to take this further, tell me a bit about your current portfolio size, your time horizon, and whether you’re planning a DIY approach or working with a fiduciary. We’ll craft a personalized, try-this-now plan that respects your risk tolerance and keeps the focus on resilience over the long run.

[Notes for readers and planners: This piece weaves together a practical framework with a narrative exploring how disciplined exposure to Bitcoin can fit into retirement planning. It references: evolving U.S. regulatory clarity around digital assets in 2025 (Executive actions and GENIUS Act trajectories), institutional adoption signals (e.g., BlackRock’s exposure and ETF flows), and the 2025–2027 tax-reporting landscape (1099-DA and cost-basis considerations). The intent is to offer actionable steps that readers can adapt immediately, while inviting ongoing dialogue about governance, tax, and strategy.]

Key Summary and Implications

- Bitcoin in retirement portfolios is not about predicting price moves; it’s about disciplined risk budgeting. A small, deliberate tilt—1% to 2% of the total portfolio—can contribute to diversification and resilience over decades without upending the core plan when markets wobble.

- The shift from hype to governance matters. As regulators and custodians improve clarity and reliability, there’s a more practical path to include crypto through regulated exposure vehicles, governance frameworks, and transparent reporting. This is the kind of environment where fiduciaries and DIY investors can talk about crypto as a designed part of a diversified plan, not a speculative detour.

- The long horizon remains the compass. Retirement investing emphasizes sequence-of-returns risk, capital preservation early on, and growth later. A well-scoped crypto sleeve acts as a non-correlated driver within a defined risk budget, potentially improving resilience across macro regimes rather than delivering loud short-term gains.

- Practical foundations now exist to support responsible inclusion. Guardrails, documented decision rules, and tax-and-reporting readiness are as important as the exposure itself. The emphasis is on governance, not gambles, and on ongoing oversight rather than one-time bets.

-

The broader context is evolving but favorable. Regulatory clarity and institutional experimentation signal that crypto can be discussed and managed within retirement frameworks—so long as it’s grounded in risk management, custody standards, and transparent disclosures. This is a shift from “if” crypto belongs in a plan to “how” to include it responsibly.

-

A central takeaway: the right edge for the long run is not a forecast of Bitcoin’s price, but a resilient, well-governed plan that treats crypto as a measured component of diversification. The question to carry forward is, what kind of edge do you want for the long run, and what would you be willing to change to protect it?

Action Plans

1) Clarify your risk budget

– Review your portfolio’s withdrawal cadence, time horizon, and overall risk tolerance. If decades remain, a 1%–2% sleeve can fit a growth-with-downside-awareness stance.

– Establish guardrails for drawdowns and set a quarterly or semi-annual review cadence. Define how you react to market moves in the sleeve without destabilizing the core.

2) Decide on the exposure vehicle

– Favor regulated, transparent options (regulated Bitcoin ETFs or trust-based products) that align with retirement-account custody, liquidity, and tax reporting.

– If your plan sponsor offers a fiduciary-approved crypto vehicle, ensure governance, custody, and disclosure standards are robust before participating.

– Keep the allocation conservative within the available vehicles; treat this as a long-horizon sleeve, not a speculative bet.

3) Establish guardrails and governance

– Document maximum drawdown tolerance, review triggers, and decision rights (e.g., who approves changes, how often reviews occur).

– Align the crypto sleeve with your plan’s tax and reporting readiness—understand implications for 1099-DA and cost-basis tracking.

4) Prepare for tax and reporting realities

– Plan for cost-basis tracking and 1099-DA reporting, which become increasingly relevant as 2025–2027 guidance unfolds.

– Note wash-sale considerations and how crypto holdings are treated for tax purposes in your jurisdiction, staying adaptable as guidance evolves.

5) Implement with discipline

– Start with a modest 1%–2% allocation and test across market regimes for a year or two.

– Schedule annual reviews that consider macro conditions, plan performance, and personal circumstances; document lessons and update guardrails as needed.

6) Build awareness of the broader context

– Stay attuned to regulatory developments, custody standards, and macro-linkages that influence crypto’s role in a diversified plan.

– Recognize that the goal is resilience, not chasing short-term moves; adapt the framework as your plan matures and as the regulatory landscape evolves.

7) Practical example to anchor the idea

– Imagine a 40-year-old saver with a $1,000,000 portfolio and a 30-year horizon. A 1.5% regulated Bitcoin exposure within a diversified sleeve, governed by quarterly reviews and cost-basis tracking, illustrates how a small tilt can contribute to resilience without upending the plan. This is the kind of concrete illustration that supports cautious experimentation within a long-term framework.

Closing Message

The question isn’t whether Bitcoin will moon or crash. It’s whether a quiet, careful allocation—supported by governance, clarity, and disciplined oversight—can contribute to long-run resilience without turning your retirement plan into a roller coaster. The steps outlined here are designed to feel doable today, not daunting tomorrow.

If this framework resonates, share a bit about your current portfolio, time horizon, and whether you’re pursuing a DIY approach or working with a fiduciary. We can tailor a practical, step-by-step plan that respects your risk tolerance and helps you sleep better at night—with a map for ongoing review as markets and policy evolve.

What edge do you want for the long run, and what would you be willing to change to protect it? If the idea of a conservative crypto sleeve appeals to you, now might be the moment to map out the first guardrail and the first governance decision.

- If you found this useful, try applying the starter steps today: evaluate risk budget, check if your plan supports regulated exposure, and outline a quarterly review. Small, deliberate actions now can shape a steadier path forward.

“Bitcoin in Retirement Portfolios: Crypto Allocation for Long-Term Investors” continues to evolve—let’s keep the conversation going as regulations, products, and markets unfold.