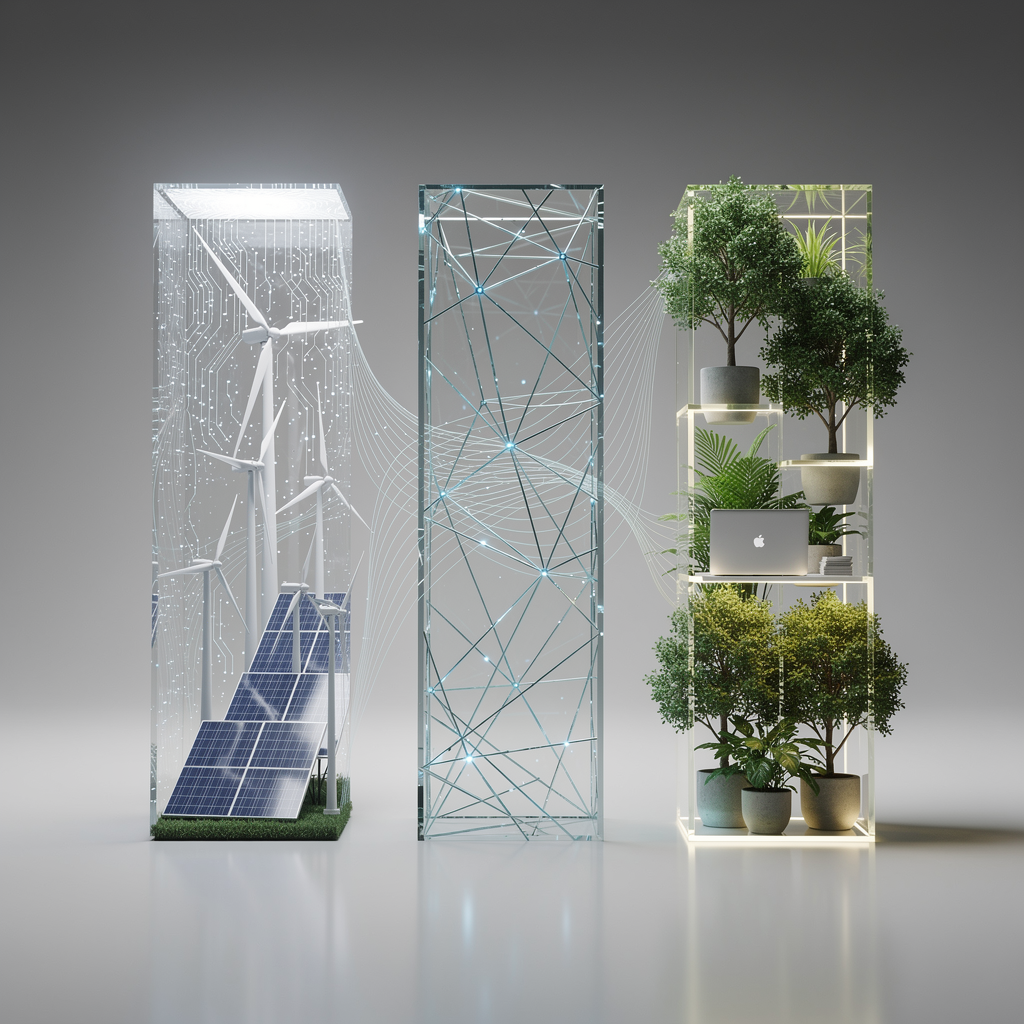

The Green Finance Showdown – Bitcoin vs Tokenized Real Estate vs ESG Funds

What if the future of sustainable finance isn’t a single banner, but a three-way handshake between mining energy, tokenized real assets, and responsible funds? It’s not a purely academic debate. In 2025, data and policy are shaping how institutions allocate, manage risk, and measure impact across crypto, real assets, and traditional ESG products. Recent findings and regulatory developments force us to confront a simple question: where should capital flow if we want transparency, efficiency, and real-world sustainability?

The energy story you can’t ignore

Bitcoin’s energy footprint has long been a flashpoint for critics and a proving ground for proponents of cleaner mining. The latest wave of data shows a more complex, and increasingly cleaner, picture. According to Cambridge’s Digital Mining report covering 2024–2025, sustainable energy sources (renewables plus nuclear) accounted for about 52.4% of mining energy, with renewables alone at 42.6% and nuclear at 9.8%. That’s progress, but it doesn’t erase the underlying demand: the network still consumes roughly 138 terawatt-hours annually and emits millions of tonnes of CO2e (about 39.8 Mt). In other words, the trend is moving toward cleaner energy, even as total demand grows. These numbers have sparked ongoing discussions among policymakers, industry players, and researchers about how to balance innovation with energy accountability. [Cambridge Digital Mining Report, 2024–2025; Cambridge release, 28 April 2025]

The conversation isn’t just about “more renewables.” It’s about credible energy accounting, grid resilience, and whether the public narrative keeps pace with measurable change. Independent validators have highlighted convergence toward a lower, more empirical footprint than early hype suggested, but the debate over what constitutes a truly sustainable crypto footprint remains active. The takeaway for investors: energy transparency is becoming a core risk signal and a nominal tailwind for those who can point to verifiable shifts in supply mix and grid emissions. [Cambridge/CCAF updates, 2024–2025; 2025 reporting]

Tokenized real estate scale, liquidity, and a changing regulatory map

If Bitcoin’s energy story is about the source of power, tokenized real estate is about the speed and security of ownership. On-chain real assets promise faster fundraising, fractional ownership, and newfound liquidity for properties that historically locked up capital for long horizons. Deloitte’s Center for Financial Services projects the global tokenized real estate market could explode to around $4 trillion by 2035, up from under $300 billion today. That kind of scale implies significant efficiencies in fundraising, custody, and on-chain ownership workflows, potentially reshaping how institutions allocate to real estate and related credit. [Deloitte forecast reported by CoinDesk, Apr 24–25, 2025]

Regulation, as ever, is the gatekeeper. Tokenized securities issued on blockchain platforms remain securities, meaning traditional securities rules still apply. This isn’t a fantasy of frictionless tokenization; it’s a push toward compliant structures—whether through Reg D/Reg S frameworks, licensed platforms, or robust disclosures and custodian arrangements. The practical implication is straightforward: if you’re evaluating tokenized real estate, you’re not just assessing illiquidity vs. liquidity; you’re assessing the robustness of the legal and custody architecture that underpins on-chain ownership. [Reuters coverage, 2025]

What makes this path compelling is a long-run narrative: when real assets can be tokenized with clear, auditable ownership and on-chain settlement, traditional barriers—fractions of property, cross-border access, and speed of settlement—shrink. The challenge remains: regulatory clarity across jurisdictions, consistent data standards, and reliable custody solutions that can stand up to institutional scrutiny.

ESG funds in a time of recalibration

ESG funds arrived with optimism and substantial inflows, but 2024 and 2025 have brought a more nuanced reality: performance questions, perceived greenwashing, and a tightening regulatory lens. Market observers note that flows cooled and performance varied, with differences across regions and sub-asset classes. The European Union’s SFDR reforms, introduced and advancing through 2025–2026, aim to simplify disclosures and reduce greenwashing risk by adopting a three-category labeling approach (sustainable, transition, ESG basics) and clarifying product-level disclosures. This is paired with ongoing CSRD revisions, which adjust the data and scope of corporate sustainability reporting—data that ESG funds rely on to substantiate claims. The net effect for investors: better clarity in what labels actually mean, but more diligence required at the product level to separate signal from noise. [EU SFDR proposals, Nov 2025; CSRD adjustments, 2025–2029; reporting trends cited by major outlets in 2025]

The macro context is equally important: flows into ESG remained sensitive to policy signals and market cycles. In a world where energy policy, corporate disclosures, and market structure are all shifting, ESG funds may offer a more predictable alignment with risk management and governance improvements, even if some price performance remains uneven. The regulatory arc isn’t a sideshow; it’s a central determinant of how trustworthy ESG claims are and how investors should price those claims into portfolios. [Morningstar and industry coverage, 2024–2025; SFDR/MSDR coverage, 2025]

What this triad means for portfolios today—and tomorrow

Three paths, one overarching question for investors: where should capital go to balance risk, return, and impact in a world of evolving policy and unprecedented data availability?

- Bitcoin as a climate-aware crypto-native allocation: The energy story improves, but the strategy hinges on credible energy accounting, evolving miner transparency, and how much of the footprint policymakers will accept in exchange for the network’s security and potential diversification benefits. The trend favors those who can demonstrate real-world energy improvements and reliable reporting, not simply headlines about energy use. [Cambridge 2025 data]

- Tokenized real estate as a liquidity accelerator for hard assets: If regulatory clarity solidifies and custody models prove robust, tokenized real estate could unlock faster fundraising, reduced friction across borders, and novel credit structures. This represents a structural shift in how institutions think about real assets and liquidity—one you might tilt toward if you value on-chain efficiency and a new class of risk controls around tokenized securities. [Deloitte forecast; regulatory context]

- ESG funds under reform: Expect continued demand for sustainable strategies, but with greater emphasis on verifiable disclosures and robust product labeling. The SFDR 2.0 push and CSRD evolutions are not merely bureaucratic changes; they’re signals about how investors, managers, and regulators will define and defend “green” in a market where capital increasingly follows data, governance, and credible impact. [SFDR 2.0 proposals; CSRD updates]

What should you do as an investor today? Start by testing your assumptions against data you can audit, and frame your decisions around three practical questions:

- Do you trust the data behind energy claims and governance disclosures, and can you verify it across time and jurisdictions? (Energy mix, reporting standards, and independent verifications matter.)

- Is your exposure to tokenized real estate supported by robust custody, clear legal structures, and transparent liquidity terms?

Green Finance Showdown: Bitcoin, Tokenized Real Estate, and ESG Funds — Which Path Will Shape the Next Decade?

I started this morning with a spill of coffee and a thought that wouldn’t sit still: what if sustainable finance isn’t a single banner but a three-way handshake among energy, on-chain real assets, and responsible investing? The question felt practical, almost tactile: what could each path offer a curious investor who wants transparency, liquidity, and real-world impact? The year is 2025, a moment when data, policy, and market structure finally seem to move with a little more harmony—or at least a common vocabulary. So I wandered through three tracks that are often treated as separate stories, but in practice are interwoven: Bitcoin’s energy transition, tokenized real estate, and ESG funds under reform. Here’s how that tapestry looks when you pull on its threads and follow where they lead.

The energy story you can’t ignore Bitcoin’s cleaner path, still marching forward

A private café conversation with a friend yesterday reminded me that energy narratives aren’t about absolutes; they’re about credibility, measurement, and timing. Bitcoin’s energy footprint has long been a flashpoint. The latest data, however, paints a more nuanced picture—a trend toward cleaner sources even as overall demand climbs. According to Cambridge’s Digital Mining Report covering 2024–2025, sustainable energy sources—renewables plus nuclear—account for roughly 52.4% of mining energy, with renewables at 42.6% and nuclear at 9.8%. The network still drinks a sizable 138 terawatt-hours annually and emits about 39.8 million tonnes of CO2e. This isn’t “green or not” but “green is improving, even if scale remains” — a crucial distinction when policymakers and industry players weigh regulation and growth. (Cambridge Digital Mining Report, 2024–2025; Cambridge release, April 28, 2025)

What does that mean in practice? It isn’t merely about renewable energy percentages; it’s about data transparency, grid resilience, and what counts as credible decarbonization in a world where the appetite for crypto security and innovation persists. Independent validators have highlighted a convergence toward a more empirical footprint, suggesting the narrative around “green mining” might finally be catching up with observable metrics. The implication for investors is practical: energy transparency becomes a risk signal and a potential tailwind for those who can anchor their bets to verifiable shifts in supply mix and emissions. (Cambridge/CCAF updates, 2024–2025; 2025 reporting)

Tokenized real estate scale, liquidity, and a changing regulatory map

If Bitcoin’s energy story centers on power, tokenized real estate is about the speed and security of ownership at scale. Tokenized real estate—the on-chain representation of real assets—promises faster fundraising, fractional ownership, and newfound liquidity for properties that used to lock capital in long horizons. Deloitte’s Center for Financial Services projects the global tokenized real estate market could explode to about $4 trillion by 2035, up from under $300 billion today. That scale implies meaningful efficiencies in fundraising, custody, and on-chain ownership workflows, and could reshape how institutions allocate to real estate and related credit. (Deloitte forecast reported by CoinDesk, Apr 24–25, 2025)

Regulation is the gatekeeper, however. Tokenized securities issued on blockchain platforms remain securities, which means traditional securities rules apply. This isn’t a fantasy of frictionless tokenization; it’s a push toward compliant structures—whether through Reg D/Reg S frameworks, licensed platforms, or robust disclosures and custody arrangements. The practical implication for you as an investor or adviser is straightforward: evaluating tokenized real estate means judging the robustness of legal structures, disclosures, and custody as much as the on-chain mechanics. (Reuters coverage, 2025)

What makes this path compelling is a long-run narrative: tokenization can unlock access to real assets with clear, auditable ownership and on-chain settlement, shrinking barriers like cross-border access, speed, and liquidity frictions. The challenge remains regulatory clarity across jurisdictions, standard data practices, and trustworthy custody that can meet institutional scrutiny. (Deloitte + Reuters discussions, 2025)

ESG funds in a time of recalibration flows, performance, and regulatory clarity

The ESG story is not dead; it’s being rewritten with tighter filters and clearer responsibility. In 2024–2025, global ESG fund inflows cooled, with critics pointing to performance concerns and greenwashing alongside policy signals. Europe remained relatively active in fixed-income ESG products, while U.S. investors pulled net funds in some quarters. This sets up a critical question: is ESG a structural growth story or a cycle catalyzed by policy incentives? (Morningstar-like coverage and 2025 market discussions)

The European Union’s SFDR reforms in 2025–2026 aim to simplify disclosures and reduce greenwashing by introducing a three-category labeling system—sustainable, transition, and ESG basics—and streamlining product-level disclosures. Expect product marketing to shift as SFDR 2.0 proposals advance, with a corresponding impact on how funds are described to investors. Simultaneously, the CSRD (corporate sustainability reporting) rules are being revised to scale back some reporting requirements for smaller firms, which in turn affects the data ESG funds rely on for credibility and decision-making. These are not merely bureaucratic changes; they reshape the backbone of ESG investing: how data is gathered, verified, and presented to the market. (EU SFDR proposals, Nov 2025; CSRD adjustments, 2025–2029; reporting trends, 2025)

The macro context matters: energy policy, governance standards, and market structure all shift investor expectations. The energy-intensive data needs of AI and data centers also compete for grid resources, which will influence how policies price crypto and digital assets going forward. In this evolving environment, ESG funds may offer a steadier anchor for risk management and governance improvements, even if performance remains uneven in certain periods. (General market coverage, 2025)

What this triad means for portfolios today—and tomorrow

Three paths, one core question: where should capital flow to balance risk, return, and impact in a world of evolving policy and unprecedented data availability?

- Bitcoin as a climate-aware crypto-native allocation: The energy story is improving, but it requires credible accounting, evolving miner transparency, and a policy climate that accepts credible decarbonization alongside network security. The trend favors investors who can point to verifiable energy transitions and consistent reporting as part of due diligence. (Cambridge 2025 data)

- Tokenized real estate as a liquidity accelerator for hard assets: If regulatory clarity strengthens and custody models prove robust, tokenized real estate could unlock faster fundraising, reduced cross-border friction, and new on-chain credit structures. This represents a structural shift in how institutions view real assets and liquidity—an option to tilt toward if you value on-chain efficiency and robust risk controls around tokenized securities. (Deloitte forecast; regulatory context)

- ESG funds under reform: Expect ongoing demand for sustainable strategies, but with a clearer map of what labels actually mean and stricter product-level disclosures. SFDR 2.0 and CSRD adjustments aren’t just cosmetic; they’re signals about how managers, investors, and regulators will define and defend “green” in a market increasingly driven by data, governance, and verifiable impact. (SFDR 2.0 proposals; CSRD updates; 2025 coverage)

What should you do as an investor today? Start by testing your assumptions against auditable data, and frame decisions around three practical questions:

- Do you trust the data behind energy claims and governance disclosures, and can you verify it across time and jurisdictions?

- Is your exposure to tokenized real estate supported by robust custody, clear legal structures, and transparent liquidity terms?

- Are you buying into a label that actually correlates with measurable impact and credible reporting rather than marketing language?

Practical takeaways for due diligence:

- Favor data provenance: energy mix data and reporting standards matter. Look for independent verifications and time-series transparency rather than single-year snapshots.

- Scrutinize custody and legal structure: tokenized real estate isn’t just a technology play; it’s a legal and operational play. Verify how on-chain ownership maps to on-chain settlements, and what happens in cross-border scenarios.

- Read product-level disclosures carefully: ESG funds are at risk of greenwashing if labels aren’t backed by auditable data. SFDR 2.0 aims to reduce obscurity, but diligence remains essential. (Regulatory notes, 2025)

Quick references you can use to ground the discussion

- Bitcoin energy data: Cambridge Digital Mining Report (2024–2025) – 52.4% sustainable energy, renewables 42.6%, nuclear 9.8%; 138 TWh; ~39.8 Mt CO2e. [Cambridge release, 2025]

- Tokenized real estate market potential: Deloitte Center for Financial Services — up to $4 trillion by 2035; current base under $300 billion. [CoinDesk coverage, 2025]

- Regulation of tokenized securities: Reuters coverage on SEC stance (2025). [Reuters, 2025]

- EU SFDR 2.0 and CSRD: European Commission announcements and industry coverage (Nov–Dec 2025). [EU SFDR proposals; CSRD adjustments]

- Broader energy/policy context: 2025 data-center and AI energy demand trends and regulatory discussions. [Major market coverage, 2025]

If you’d like, I can turn this into a ready-to-publish blog post with a polished outline, talking points, and citations in the style you prefer (APA, Chicago, etc.). I can tailor the angles toward institutional investors, retail readers, or policymakers, or adjust the depth for a short explainer versus a long-form feature.

Primary takeaway: in 2025, the future of sustainable finance looks less like a single banner and more like a three-way handshake among energy transparency, tokenized real assets, and rigorous, verifiable ESG disclosures. The central question remains: where should your capital flow to maximize transparency, efficiency, and real-world sustainability—and what does that imply for your life as an investor, steward, or policymaker?

What’s your next move in this three-path landscape? Do you want to start with a concrete audit of energy reporting, a pilot in tokenized real estate, or a due-diligence framework for ESG disclosures in your portfolio? Wouldn’t it be worth mapping your answers to the three paths and watching where the data takes you?

Three Paths, One Portfolio: The Green Finance Showdown

This morning began with a spill of coffee and a question that wouldn’t sit still: what if sustainable finance isn’t a single banner, but a three-way handshake among energy transparency, tokenized real assets, and responsible funds? The year is 2025, and data, policy, and market structure are finally sharing the same language — but the conversation is far from a finished verdict. It’s a living, shifting negotiation among systems that want to be credible, liquid, and aligned with real-world impact.

The energy story you can’t ignore: Bitcoin’s cleaner path, still marching forward

A private chat with a colleague reminded me that energy narratives aren’t about absolutes; they’re about credibility, measurement, and timing. The latest data suggest a more nuanced arc: energy sources for mining are cleaner than before, even as demand grows. Cambridge’s Digital Mining Report (2024–2025) shows sustainable energy sources (renewables plus nuclear) at about 52.4% of mining energy, with renewables at 42.6% and nuclear at 9.8%. The grid still supports roughly 138 terawatt-hours annually and emissions hover around 39.8 million tonnes of CO2e. This isn’t a simple “green vs. not” story; it’s a trend toward verifiable decarbonization that outpaces headlines. For investors, energy transparency becomes a risk signal and a potential tailwind for those who can anchor bets to auditable shifts in supply mix and grid emissions. (Cambridge Digital Mining Report, 2024–2025; Cambridge release, 2025)

What does that imply in practice? It’s not about one number; it’s about credibility, reporting cadence, and whether policy makers will accept credible decarbonization alongside network security. The conversation has moved from “Is this good or bad?” to “Can we verify progress over time, across jurisdictions, with independent checks?” The practical takeaway is clear: energy transparency isn’t cosmetic — it’s a real-risk signal and a potential advantage for capital that can point to verifiable improvements.

Tokenized real estate: scale, liquidity, and a changing regulatory map

If the Bitcoin energy story answers the question of power, tokenized real estate is about speed, custody, and ownership clarity at scale. On-chain real assets promise faster fundraising, fractional ownership, and newfound liquidity for properties that used to lock capital for long horizons. Deloitte’s Center for Financial Services projects the global tokenized real estate market could reach about $4 trillion by 2035, up from under $300 billion today. Scale like that accelerates efficiencies in fundraising, custody, and on-chain ownership workflows, and could reshape how institutions think about real assets and liquidity. (Deloitte forecast via CoinDesk, 2025)

Regulation is the gatekeeper. Tokenized securities issued on blockchain platforms remain securities, so traditional securities rules apply. This isn’t a dream of frictionless tokenization; it’s a push toward compliant structures — whether through Reg D/Reg S frameworks, licensed platforms, or robust disclosures and custody arrangements. The practical implication: evaluating tokenized real estate means judging the strength of legal structures, disclosures, and custody as much as the on-chain mechanics. (Reuters coverage, 2025)

What makes this path compelling is a long-run narrative: tokenization could shrink barriers to real assets — cross-border access, speed, and liquidity — if regulatory clarity and custody solutions keep pace with the technology. The challenge remains consistent data standards and trustworthy custody that can weather institutional scrutiny. (Deloitte + Reuters discussions, 2025)

ESG funds in a time of recalibration clarity, discipline, and credible labels

The ESG story isn’t dead; it’s being rewritten with tighter filters and stronger responsibility. In 2024–2025, inflows cooled in some markets, and performance varied. Critics point to greenwashing, while policy signals push toward more accountable disclosures. The EU’s SFDR reforms aim to simplify disclosures and reduce greenwashing by introducing a three-category labeling system — sustainable, transition, and ESG basics — and by clarifying product-level disclosures. CSRD revisions also shape the data ESG funds rely on for credibility. The net effect: better clarity about what labels mean, but more diligence required at the product level. (EU SFDR proposals; CSRD adjustments; 2025 coverage)

The macro backdrop matters: energy policy, governance standards, and market structure are shifting investor expectations. In this environment, ESG funds may offer a steadier anchor for risk management and governance improvements, even if price-performance is uneven in some periods. Regulatory momentum isn’t a sideshow; it’s central to how trustworthy green claims are and how investors price those claims into portfolios. (Industry coverage, 2025)

What this triad means for portfolios today—and tomorrow

Three paths, one core question: where should capital flow to balance risk, return, and impact amid evolving policy and unprecedented data access?

- Bitcoin as a climate-aware crypto-native allocation: The energy story is improving, but success hinges on credible accounting, evolving miner transparency, and a policy environment that accepts credible decarbonization alongside network security. The winners are those who can demonstrate verifiable energy transitions and consistent reporting as part of due diligence. (Cambridge 2025 data)

- Tokenized real estate as a liquidity accelerator for hard assets: If regulatory clarity solidifies and custody models prove robust, tokenized real estate could unlock faster fundraising, reduced cross-border friction, and new on-chain credit structures. This marks a structural shift in how institutions view real assets and liquidity — a path to tilt toward if you value on-chain efficiency and credible risk controls around tokenized securities. (Deloitte forecast; regulatory context)

- ESG funds under reform: Expect continued demand for sustainable strategies, but with clearer meanings for labels and stricter product-level disclosures. SFDR 2.0 and CSRD updates aren’t cosmetic; they redefine how managers, investors, and regulators defend the claim of “green” in a data-driven market. (SFDR 2.0 proposals; CSRD updates; 2025 coverage)

What should you do as an investor today? Start by testing your assumptions against auditable data and frame decisions around three practical questions:

- Do you trust the data behind energy claims and governance disclosures, and can you verify it across time and jurisdictions? (Energy mix data, reporting standards, independent verifications)

- Is your exposure to tokenized real estate supported by robust custody, clear legal structures, and transparent liquidity terms?

- Are you buying into a label that actually correlates with measurable impact and credible reporting rather than marketing language?

Practical due-diligence takeaways:

– Favor data provenance: seek energy mix data that can be verified over time, with independent checks rather than single-year snapshots.

– Scrutinize custody and legal structure: tokenized real estate isn’t just a tech play; it’s a legal and operational one. Confirm how on-chain ownership maps to settlement and what happens in cross-border scenarios.

– Read product-level disclosures carefully: ensure ESG labels reflect auditable data, not marketing claims. SFDR 2.0 aims to reduce obscurity, but diligence remains essential. (Regulatory notes, 2025)

Actionable paths you can start today

- Build an auditable energy-data framework for any crypto exposure, with clear timelines and third-party verifications.

- Pilot a tokenized real estate investment with defined custody arrangements, custodial disclosures, and transparent liquidity terms.

- Re-evaluate ESG fund selections against label definitions and disclosures; benchmark products against verifiable governance metrics and real-world impact data.

Closing reflection the next move is yours

If you’re honest, you’ll admit these paths aren’t mutually exclusive. They’re potentially complementary routes to the same destination: more trustworthy, efficient, and real-world-aligned finance. The question is not which path is “best,” but which combination best fits your purpose, your risk tolerance, and your ability to measure what matters.

What will your first step be in this three-path landscape? Will you start with a credible energy data audit, a tokenized real estate pilot, or a rigorous review of ESG disclosures in your portfolio? Sharing your plan could spark a constructive exchange — perhaps we can map the data to your exact context and watch where the signal takes you.

Quick references you can ground the discussion with

- Bitcoin energy data: Cambridge Digital Mining Report (2024–2025) — 52.4% sustainable energy; renewables 42.6%; nuclear 9.8%; 138 TWh; ~39.8 Mt CO2e. [Cambridge release, 2025]

- Tokenized real estate market potential: Deloitte Center for Financial Services — up to $4 trillion by 2035; current base under $300 billion. [CoinDesk, 2025]

- Regulation of tokenized securities: Reuters coverage on SEC stance (2025). [Reuters, 2025]

- EU SFDR 2.0 and CSRD: EU announcements and industry coverage (Nov–Dec 2025). [SFDR proposals; CSRD updates, 2025]

- Broader energy/policy context: 2025 data-center and AI energy demand trends and regulatory discussions. [Industry coverage, 2025]

If you’d like, I can tailor this into a publish-ready blog post with polished outline, talking points, and citations in your preferred style, and align the depth for institutional or retail readers, or a concise explainer versus a long-form feature.

Primary takeaway: in 2025, sustainable finance looks less like a single banner and more like a triad — energy transparency, tokenized real assets, and rigorous, verifiable ESG disclosures. The central question remains: where should your capital flow to maximize transparency, efficiency, and real-world sustainability — and what does that imply for your role as investor, steward, or policymaker?

What’s your next move in this three-path landscape?