Can Your Driving Habits Really Slash Your Insurance Bill? Exploring Usage-Based Car Insurance

Have you ever wondered if the way you drive could directly influence how much you pay for car insurance? It’s almost intuitive to think insurance rates are set in stone, based on your age, location, or car model. But what if your actual behavior behind the wheel—the smooth brakes, cautious turns, or even how often you hit the road—could tip the scales in your favor?

This is where usage-based car insurance (UBI) steps in, a concept that’s been quietly revolutionizing the insurance industry. Imagine a system that monitors your driving patterns using telematics technology—devices or apps that collect data on speed, mileage, and braking habits—and adjusts your premium accordingly. It’s a shift from broad generalizations to personalized risk assessment.

The market for UBI is expanding rapidly. Recent figures show it jumped from a $52 billion valuation in 2023 to an anticipated $83 billion by 2025. This growth reflects not only technological advancements but also a demand for fairness and customization in insurance. But with all this data collection, questions about privacy and data security naturally arise. How comfortable are we with sharing detailed driving information? And do the savings truly outweigh these concerns?

If you’re a driver curious about cutting costs without compromising safety or coverage, understanding usage-based insurance could be a game changer. This article will walk you through how UBI works, the types of programs available, practical tips on whether it might suit your driving habits, and what to watch out for in terms of privacy and regulations.

Rather than diving into complex jargon or overwhelming statistics, we’ll explore this together—question the benefits, weigh the risks, and see if this modern insurance approach aligns with your lifestyle. Could this be the key to smarter, fairer car insurance? Let’s find out.

Is Usage-Based Insurance Really Worth It? Diving Deeper Into Telematics and Savings

I remember the first time I heard about usage-based insurance (UBI). It sounded almost too good to be true—a system that could adjust your car insurance premium based on how carefully you drive rather than broad categories like age or location. It piqued my curiosity: how exactly does this work, and is it really a way to save money without sacrificing coverage?

Understanding the Technology Behind UBI

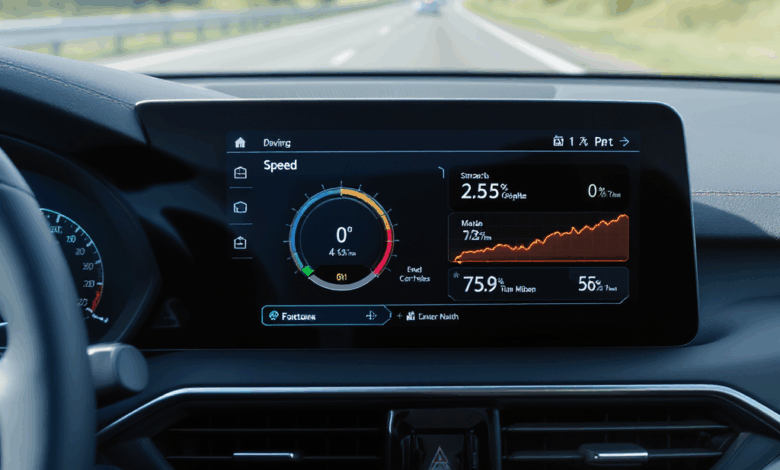

At its core, UBI leans on telematics—technology that monitors your driving behavior through devices plugged into your car’s OBD-II port, embedded systems, or smartphone apps. These gadgets collect data on speed, braking patterns, mileage, and even the time of day you drive. It feels like having a silent passenger taking notes on your every move.

But what happens with this data? Insurers use AI and machine learning models to analyze these driving patterns, assessing risk more granularly than traditional methods. So rather than lumping you into a category based on your age or ZIP code, they consider how you drive. This approach promises fairness: safer drivers pay less, while riskier habits might raise premiums.

Different Flavors of UBI Programs

If you’re thinking about dipping your toes into UBI waters, it helps to know there isn’t a one-size-fits-all approach. Three main types dominate the market:

- Pay-How-You-Drive (PHYD): Here, your premium fluctuates based on driving habits—speeding, harsh braking, and acceleration all factor in.

- Pay-As-You-Drive (PAYD): This focuses on mileage. The less you drive, the less you pay, which can be great for occasional drivers.

- Manage-How-You-Drive (MHYD): This is more interactive. Insurers provide feedback and coaching to help you improve your driving, potentially lowering your premiums over time.

Each has its merits and quirks. For example, if you’re a cautious driver with a predictable schedule, PHYD might reward you best. But what if your job requires frequent travel? PAYD could be more beneficial. The MHYD model appeals if you’re eager to refine your skills and save in the long run.

What Should You Prepare Before Signing Up?

I’d recommend starting with a candid self-assessment. Reflect on your typical driving behaviors:

- Do you mostly drive during off-peak hours?

- How often do you find yourself braking hard or speeding?

- What’s your average weekly mileage?

Knowing this helps you anticipate whether UBI could favor your profile. Also, ask insurers specific questions about data handling:

- What exact data do they collect?

- How long is it stored?

- Who has access to it?

Understanding these aspects isn’t just about privacy—it can influence your comfort level and trust in the program.

Navigating Privacy and Legal Aspects

It’s natural to feel a twinge of unease knowing your driving habits are constantly monitored. Recent regulations in states like Alabama, Iowa, and Utah are attempts to safeguard consumers, ensuring transparency and data protection. Still, it’s wise to keep abreast of your local laws and insurer policies. Remember, your data is valuable, and knowing how it’s used empowers you to make informed decisions.

Real-World Tips to Maximize UBI Benefits

If you decide to try a UBI program, here are some practical steps to consider:

- Drive Mindfully: Smooth acceleration and braking, obeying speed limits, and avoiding distractions can improve your scores.

- Monitor Feedback: Many programs offer apps or portals with driving reports—use them as a mirror to your habits.

- Compare Offers: Insurers vary widely in their UBI plans. Look beyond discounts—consider customer service, data policies, and flexibility.

- Stay Updated: UBI is evolving rapidly. New technological integrations and regulatory changes might affect your coverage or benefits.

Reflecting on the Journey Ahead

So, what do you think? Could sharing your driving data be a fair trade for personalized premiums and safer roads? Or does the idea of constant monitoring feel intrusive, even if it promises savings?

As someone drawn to both technology and fairness, I find usage-based insurance a fascinating experiment in balancing innovation with privacy. It challenges the old insurance paradigms and asks us to rethink how risk is measured.

But like any new frontier, it brings questions as much as answers. Perhaps the real journey lies not just in saving money, but in discovering how technology reshapes trust between drivers and insurers.

Would you take the leap and try a usage-based insurance plan? Or does the thought of being watched keep you firmly in the traditional lanes? The road ahead is open—let’s navigate it thoughtfully together.

Looking back on our exploration of usage-based car insurance (UBI), it becomes clear that this innovation represents more than just a new pricing model—it’s a shift towards personalization and fairness in an industry often seen as rigid and impersonal. By tapping into telematics technology, insurers now have the tools to reward safer, more mindful driving behaviors, potentially transforming how we think about risk and responsibility on the road.

This journey through UBI also surfaces a deeper conversation about trust and privacy. As we weigh the promise of savings against the realities of data collection, we’re invited to rethink our relationship with technology and how much of ourselves we’re willing to share for tangible benefits. It’s a delicate balance, one that challenges both drivers and insurers to evolve.

So, what can you do next? Start by reflecting honestly on your driving habits—when and how you drive, how cautious you are behind the wheel—and seek out insurers offering UBI programs that align with your lifestyle and comfort level with data sharing. Don’t hesitate to ask questions about data security and privacy policies; being informed is your strongest ally. Try out apps or devices that provide feedback on your driving, turning this tech into a tool for improvement rather than just monitoring.

Looking ahead, as telematics and AI continue to advance, UBI could become even more tailored and interactive, perhaps integrating with broader smart city initiatives or vehicle automation. This evolving landscape promises exciting possibilities but also calls for ongoing vigilance about how our data is used and protected.

Ultimately, embracing usage-based insurance is not just about saving money—it’s about engaging in a thoughtful experiment on how technology can redefine fairness and trust in everyday life. So, what do you think? Could this be the smarter, fairer way forward for car insurance? If this idea resonates with you, why not take the first step and explore a UBI option that suits your driving style? The road to change starts with a single mile.