Can BTC Bridges Earn Bitcoin’s Trust Again? A Practical Guide to Security Risks and Best Practices

I was reminded last week, during a quiet hallway conversation with a veteran BTC bridge engineer, that trust in cross-chain movement isn’t granted by clever math alone. It’s earned—through careful design, disciplined operation, and relentless monitoring. If you’ve ever watched a bridge slip from a custody model to a trust-minimized one, you know the tension: freedom to move BTC across chains without surrendering control, paired with the responsibility to prove that freedom is safe. So how do we build bridges that we can sleep beside, not wake up fearing?

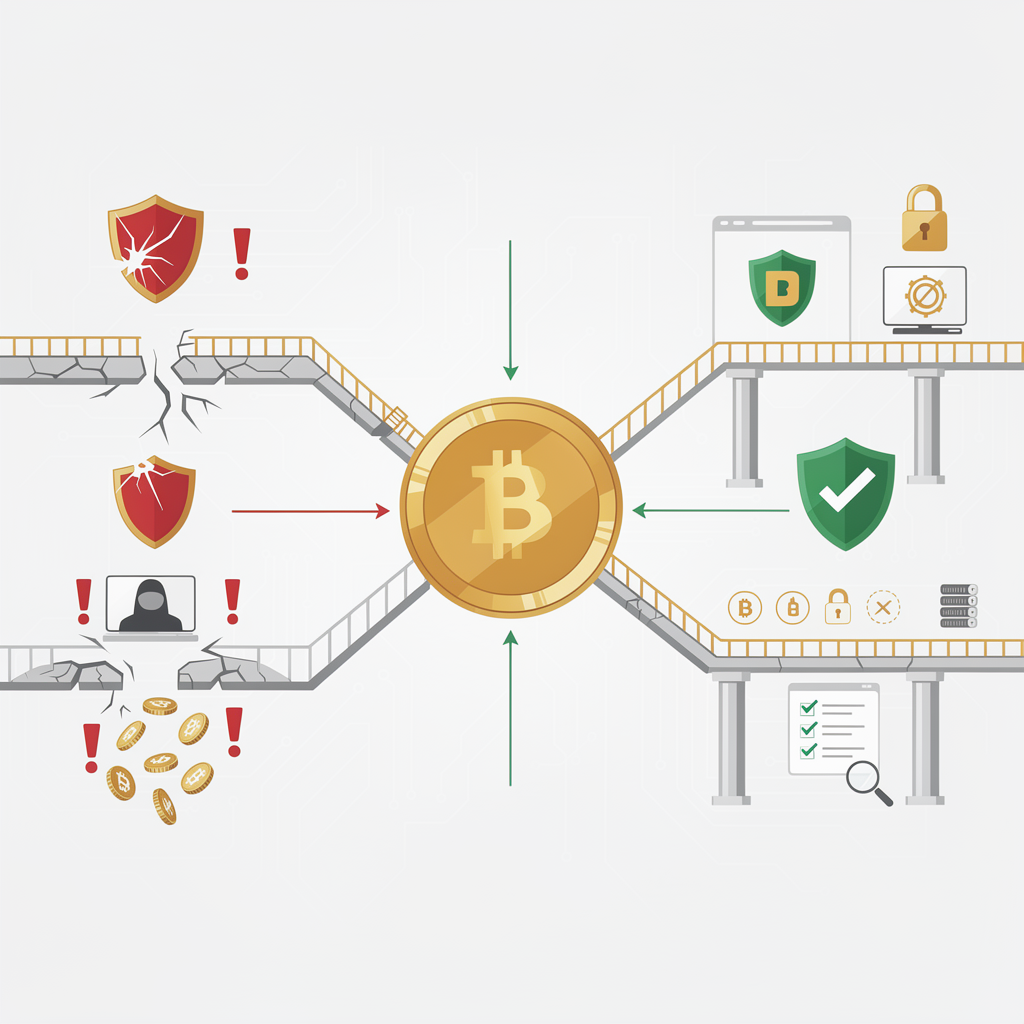

What if the answer isn’t a single clever trick, but a concerted architecture of safety, transparency, and continuous verification? That question sits at the heart of today’s BTC cross-chain conversations, where new designs promise to reduce custodial risk while expanding Bitcoin’s DeFi reach. The stakes aren’t theoretical: in 2025, the industry grappled with real attacks, governance debates, and the push toward formal security attestations for cross-chain messaging and value transfers. This piece offers a practical lens on what changed, what’s changing, and how you can apply those lessons in your own projects.

The Problem We Face

Cross-chain bridges are high-value targets. Even as the fever for multi-chain liquidity grows, the attack surface expands across contract logic, key management, oracles, and cross-chain messaging. The year 2025 brought renewed emphasis on monitoring, formal verification, and rapid incident response as core design concerns, not afterthoughts. In parallel, BTC-native or BTC-first approaches began to shift the risk profile away from custodians toward trust-minimized designs, signaling a meaningful architectural pivot for Bitcoin interoperability. You don’t have to take my word for it—look at the direction these leading projects are taking:

- Union on Rootstock represents a pivotal move toward trust-minimized BTC bridging. Built on BitVMX, it aims to reduce custodial trust and enable BTC movement into Rootstock’s DeFi stack. The roadmap even tracks a path to mainnet in late 2025 as a centerpiece of BTCFi strategy. ([rootstock.io], [arxiv.org/abs/2501.07435])

- Threshold’s tBTC continues to push direct, gasless minting across multiple networks, expanding BTC access to non-EVM chains and L2s with a governance-driven roadmap. ([threshold-bridge.net])

- Axelar broadens cross-chain reach with hub-and-spoke security and enterprise-oriented updates, connecting 60+ chains while strengthening security through verifiable cross-chain messaging. ([axelar.network], [coindesk.com])

- Formal security work and risk detection are maturing: tools like BridgeShield and ConneX push toward real-time cross-chain risk monitoring and provenance verification. ([arxiv.org], [arxiv.org])

In short, the field is moving from “move BTC across chains” to “move BTC across chains safely, with auditable proofs and strong governance.” The implication for developers is clear: design choices now affect how quickly and safely you can grow multi-chain BTC strategies tomorrow.

Why This Article Matters

If you’re building or evaluating BTC cross-chain capabilities, you want a practical framework you can apply today. This article ties together recent developments with concrete best practices you can adopt, including:

- A layered view of risk across messaging, custody, contract logic, and governance, with concrete mitigations at each layer.

- Real-world architectural patterns from leading projects (Union, tBTC, Axelar) that illustrate how to reduce trust assumptions without sacrificing usability.

- A path to security maturity that aligns with industry movements toward formal attestations (ISO 27001, SOC 2), multi-chain governance, and rigorous incident response. References to the latest developments provide a trustworthy context for decision-making. For example, Chainlink CCIP’s certifications set a higher bar for cross-chain data and value transfers, which in turn informs how you design your bridge and relay layers. ([blog.chain.link], [arxiv.org])

What you’ll get from this guide is less a fixed recipe and more a practical mindset: how to think about trade-offs, how to structure verification and monitoring, and how to grow a BTC bridge program that can adapt as the landscape evolves. As you read, consider how these ideas could map onto your own deployment patterns and governance models, and which security controls you’d want in place before you ship on mainnet.

What This Landscape Looks Like in 2025

- Trust-minimized BTC bridging is rising: architectures aim to move BTC with minimal custodial reliance, creating safer rails for BTC DeFi. Union on Rootstock is a centerpiece, with a 1-of-n honest model designed to curb reliance on any single custodian. ([rootstock.io], [arxiv.org/abs/2501.07435])

- Multi-chain minting and liquidity are expanding: gasless minting and cross-chain BTC representations are spreading across Ethereum, Layer 2s, and select non-EVM networks, broadening BTC’s on-chain utility while trying to preserve security guarantees. ([threshold-bridge.net])

- Interoperability layers gain credibility through standards: hub-and-spoke approaches, formal attestations, and governance frameworks are gaining traction, strengthening confidence in cross-chain transfers. ([axelar.network], [blog.chain.link], [coindesk.com])

- Security tooling and research mature: new detection and provenance tools aim to spot and trace cross-chain exploits and enable forensics across bridges. ([arxiv.org], [arxiv.org])

These trends aren’t just interesting; they’re actionable. They suggest a practical pathway for teams building BTC bridges: adopt trust-minimized designs where possible, rely on robust cross-chain messaging and verification, and invest in monitoring and incident response as core capabilities, not as afterthoughts.

A Practical Guide: Core Takeaways you can Apply

- Design for trust minimization where appropriate. Favor architectures that reduce reliance on custodians and enable cryptographic proofs of BTC movement across chains. Union’s approach provides one blueprint, while Threshold’s gasless minting shows another viable pattern for broad reach. ([rootstock.io], [arxiv.org/abs/2501.07435], [threshold-bridge.net])

- Use formal security attestations and recognized standards where possible. Security certifications and auditable cross-chain messaging help establish a credible baseline for enterprise-grade deployments. Chainlink’s ISO 27001 and SOC 2 Type 1 attestations illustrate where the market is heading. ([blog.chain.link])

- Invest in detection, forensics, and rapid incident response. As bridges grow, so do the attack surfaces. Proactive monitoring, anomaly detection (BridgeShield), and cross-chain provenance tracking (ConneX) become indispensable parts of the security toolkit. ([arxiv.org], [arxiv.org])

- Build with governance and upgradeability in mind. Non-custodian designs often require flexible yet secure governance models to address evolving threats and protocol changes without compromising safety. ([axelar.network], [rootstock.io])

A Simple, Actionable Checklist

- Map your risk to four layers: messaging, custody, contract logic, and governance. For each layer, identify a top-three risk and a corresponding mitigation.

- Favor threshold cryptography and multi-sig designs over single-key custody when moving BTC across chains.

- Require cryptographic proofs or verifiable bridges for asset transfers, not just event logs or off-chain attestations.

- Plan for formal verification and security audits of contracts and cross-chain message handlers before going live.

- Implement comprehensive monitoring, alerting, and incident response playbooks; practice tabletop exercises with your team.

- Prepare for upgradeability controls that prevent unplanned changes without proper governance and external review.

- Consider the long-view: how would your design endure post-quantum threats, and what quantum-resistant primitives are feasible today?

If you’re a developer or security professional, start with an architectural sketch for your bridge that prioritizes trust minimization, then layer in monitoring, audits, and governance protocols. The most important takeaway isn’t a single “best practice” but a disciplined approach to building safety into the core design from day one.

Final Reflection

As you close this piece, I’ll leave you with a question to carry into your next design review: in a world where BTC can travel across dozens of chains, what guarantees — beyond clever cryptography — are you prepared to offer that your users can actually trust on day one and year two? Are your safety nets strong enough to catch both the obvious exploits and the quiet, creeping risks that only become visible after deployment? If we can answer that with confidence, maybe we can truly earn Bitcoin’s trust again.

Can Bitcoin Travel Across Chains Safely? Designing Bridges You Can Trust at Night

I was standing in a quiet corridor after a conference, chatting with a veteran BTC bridge engineer who had watched the space evolve from custodial rails to multi-chain, non-custodial ambitions. He leaned in and whispered, almost conspiratorially, that trust isn’t granted by clever math alone. It’s earned through architecture that feels safe enough to sleep beside. The moment stuck with me: if you want Bitcoin to move across chains without surrendering control, you need more than a clever cipher—you need a system that proves its safety day after day, under real-world pressure.

This article isn’t a single silver bullet. It’s a practical landscape—an invitation to think with your hands as well as your head. We’ll walk through what changed in 2025, what it means for builders, and a concrete blueprint you can adapt today to design BTC cross-chain bridges that are auditable, upgradeable, and genuinely safer than the custodial status quo.

The Problem We Face

Cross-chain bridges are high-value targets, even when the math looks perfect on paper. In 2025, the field keeps returning to the same core fracture lines:

- Messaging and verification: how do you prove that BTC moved across chains without relying on a trusted oracle that could misreport or fail?

- Custody and key management: is there a single point of failure, or can you distribute trust so no one actor can rewind or steal funds?

- Smart contract logic: bugs in bridge contracts can cascade across chains, leading to lost assets or broken invariants.

- Governance and upgrades: how do you evolve security practices without opening backdoors to attackers or creating opaque changes?

The trend is clear: industry movers want less custodial risk and more cryptographic proofs, better monitoring, and auditable cross-chain messages. In other words, safer rails for BTC DeFi that still feel fast, usable, and scalable.

What Changed in 2025

Two threads shaped the year’s thinking:

- Trust-minimized BTC bridging gains prominence

- Union on Rootstock aims to move BTC with minimal custodial risk by building on BitVMX and pursuing a mainnet launch in 2025. The idea is to remove central custodians and anchor BTC transfers in Bitcoin’s security properties while enabling DeFi activity on Rootstock. ([rootstock.io], [arxiv.org/abs/2501.07435])

- The academic articulation of Union emphasizes a 1-of-n honest assumption as a practical balance between security and usability, shaping how developers think about BTC bridge risk. ([arxiv.org/abs/2501.07435])

- Multi-chain minting and interoperability layers expand reach but demand stronger safety nets

- Threshold Network’s tBTC continues to push direct, gasless minting across multiple networks, widening BTC access to both EVM and non-EVM ecosystems. The roadmap includes cross-network minting and enhanced UX for institutions. ([threshold-bridge.net])

- Axelar and similar hub-and-spoke models broaden cross-chain reach while prioritizing verifiable cross-chain messages and scalable governance. This creates more options for BTC-related workflows while raising the bar for security discipline. ([axelar.network], [coindesk.com])

- Security tooling and risk detection mature

- New detection and provenance projects (BridgeShield, ConneX) demonstrate a growing capability to spot cross-chain attack patterns in near real time and trace the provenance of transactions across bridges. These tools respond to the reality that monitoring and forensics are now part of the design process. ([arxiv.org], [arxiv.org])

- Certification and standards push enterprise-grade confidence

- Formal attestations and certifications around cross-chain data and value transfers, such as ISO 27001 and SOC 2-type reviews associated with chains and messaging layers, begin to shape what “secure” means for cross-chain deployments. Chainlink CCIP’s certifications are a notable signal in this direction. ([blog.chain.link], [axelar.network], [coindesk.com])

What These Changes Mean for Builders

- We’re moving away from single-point custody toward architecture that reduces trust assumptions while preserving usability. Union’s approach shows a concrete BTC-first path toward trust minimization; Threshold demonstrates how gasless minting can scale BTC utility; Axelar illustrates how hub-and-spoke security can support many chains with auditable messaging. [rootstock.io], [arxiv.org], [threshold-bridge.net], [axelar.network]]

- Security is rising as a first-class design constraint, not a post-launch afterthought. This includes formal verifications, rigorous audits, and the adoption of security attestations as real market expectancies. The practical implication is that safety controls, monitoring, and incident response need to be baked in from the earliest design decisions. ([blog.chain.link], [arxiv.org])

- The battlefield is not just code. Governance, upgrade pathways, and incident playbooks matter as much as cryptographic primitives. The best designs are resilient not only to bugs but to organizational missteps and evolving threat models. ([axelar.network], [rootstock.io])

Patterns You Can Apply Today

- Trust-minimized BTC movement leveraging multi-signature and threshold cryptography where appropriate, to reduce single points of failure while maintaining usability. Look to tBTC for practical patterns of gasless minting across diverse ecosystems. ([threshold-bridge.net])

- Verifiable cross-chain proofs and attestations rather than raw event logs. Where possible, require cryptographic proofs of transfer and verifiable state transitions, not only off-chain attestations. This aligns with a broader shift toward verifiable bridges. ([arxiv.org], [axelar.network])

- Hub-and-spoke with strong governance as a design choice for scalability. A central message relay (the hub) can serve many chains, but it must be governed transparently with upgrade paths that are auditable and time-delayed to prevent rapid, unsafe changes. ([axelar.network], [chainlink.ccip])

- Proactive risk monitoring and forensics as an ongoing capability. Tools like BridgeShield and ConneX illustrate a future where you can detect, trace, and respond to cross-chain anomalies long after deployment. ([arxiv.org], [arxiv.org])

A Practical, Actionable Guide You Can Use Now

1) Design with four layers in mind

– Messaging: ensure cross-chain data or instruction transfers come with cryptographic proofs or verifiable states. Avoid relying solely on event logs.

– Custody: favor distributed trust models (multisig, threshold schemes) over single-key custody; reduce custodial risk without sacrificing control.

– Contract logic: pursue formal verification where feasible; ensure bridge logic is modular, auditable, and upgradeable through governed processes.

– Governance: implement clear upgrade paths, external reviews, and time-locked changes to prevent impulsive or malicious alterations.

2) Pick a pattern that fits your risk appetite and users

– If you want broad BTC utility with solid risk controls, explore a trust-minimized approach on a Rootstock/BitVMX-like design, complemented by independent verification layers. ([rootstock.io], [arxiv.org/abs/2501.07435])

– For faster time-to-market with broad chain coverage, study threshold-cryptography-based minting (gasless where supported) as a pragmatic bridge into multiple ecosystems. ([threshold-bridge.net])

– Consider a hub-and-spoke layer with a robust governance framework for enterprise-grade deployments, especially if you plan to connect many chains and partner ecosystems. ([axelar.network], [blog.chain.link])

3) Build for verification and auditability from day one

– Plan formal verifications and third-party audits of bridge contracts and message handlers before mainnet deployment.

– Seek certifications or align with standards where feasible (ISO 27001, SOC 2) to meet enterprise expectations and build user trust. Chainlink CCIP’s certification path provides a useful reference point. ([blog.chain.link], [arxiv.org])

4) Invest in monitoring, detection, and response

– Deploy or adapt real-time risk-detection tools that can flag abnormal bridge activity across chains. Regularly run tabletop exercises to validate incident response playbooks. ([BridgeShield], [ConneX])

– Build a provenance layer that can trace and verify cross-chain transfers, improving forensics and post-incident analysis. ([ConneX], [arxiv.org])

5) Prepare for upgradeability and post-quantum realities

– Design upgrade processes that require multi-party governance and time delays to prevent harmful rapid changes. Consider future-proofing primitives against emerging quantum risks where feasible today. ([arxiv.org], [rootstock.io])

A Simple, Actionable Checklist

- Map risk to four layers: messaging, custody, contract logic, governance. List the top three risks per layer and propose concrete mitigations.

- Favor threshold cryptography or multi-sig designs over single-key custody when moving BTC across chains.

- Require cryptographic proofs or verifiable bridges for asset transfers, not just on-chain events.

- Plan formal verification and security audits before going live.

- Implement comprehensive monitoring, alerting, and incident-response playbooks; run tabletop exercises quarterly.

- Build upgradeability controls with external governance and review.

- Consider long-term resilience, including emerging post-quantum primitives, and assess what is feasible today.

Final Reflection

As you close this piece, I’ll leave you with a question to carry into your next design review: in a world where BTC can travel across dozens of chains, what guarantees — beyond clever cryptography — are you prepared to offer that your users can trust on day one and year two? Are your safety nets strong enough to catch both the obvious exploits and the quiet, creeping risks that only become visible after deployment? If we can answer that with confidence, perhaps we can truly earn Bitcoin’s trust again.

Note on the Landscape (Context for Practitioners)

- The movement toward BTC-native and BTC-first bridges reflects a broader shift in the ecosystem: reducing custodial risk while expanding DeFi reach requires integrated risk management, stronger governance, and audit-ready infrastructure. Real-world deployments are already testing these ideas in Rootstock, Threshold, and Axelar-style architectures, and the security research community is delivering tools to detect and analyze cross-chain threats in real time. For teams planning deployments, aligning with formal attestations and adopting verifiable cross-chain messaging are steps toward enterprise-grade reliability. (References: Rootstock 2025 roadmap; Union/Multi-chain papers; Threshold and Axelar ecosystem notes; BridgeShield and ConneX; Chainlink ISO/SOC attestations)

BTC Cross-Chain Bridges: Security Risks and Best Practices — Conclusion and Wrap-up

Trust in cross-chain BTC movement isn’t won by clever math alone; it’s earned day by day through architecture that proves its safety and through disciplined operations. The year 2025 pushed the field from a race to move BTC across chains into a race to move BTC across chains safely—with auditable proofs, robust governance, and continuous verification. This conclusion distills what changed, why it matters for builders, and how to turn insight into action in your next project.

Key Summary and Implications

- The design frontier has shifted from custodial trust to trust-minimized architectures. Projects like Union on Rootstock are pushing toward minimal custodial risk by embedding Bitcoin’s security properties into cross-chain rails, while gasless minting and multi-chain representations broaden access without surrendering safety. This isn’t merely a clever trick; it’s a shift in fundamental assumptions about who controls BTC across borders and how that control is proven. Recent patterns suggest that cryptographic proofs, verifiable cross-chain messaging, and time-delayed governance are becoming baseline expectations for enterprise-grade bridges.

- Monitoring, verification, and incident readiness are now core design requirements. Real-time risk detection (BridgeShield, ConneX) and formal verification work are moving into standard practice, not afterthoughts. The consequence for builders is clear: safety controls, auditing, and incident response must be baked in from day one, with upgrade paths that are transparent and auditable.

- Governance and upgradeability are as critical as the cryptography. The ability to evolve safely in a multi-chain ecosystem—without enabling rapid, insecure changes—depends on robust, time-locked governance and rigorous external reviews. This broader discipline—governance as a safety net—shapes how fast and how safely you can scale BTC interoperability.

From these shifts, a practical takeaway emerges: design decisions today determine how quickly you can deploy, verify, and mature BTC cross-chain capabilities tomorrow. The broader implication is that safety, transparency, and continuous verification are not optional add-ons but core competencies of any credible bridge program.

Action Plans

1) Map risk across four layers and act

– Messaging: require cryptographic proofs or verifiable states for transfers, not just on-chain events.

– Custody: favor distributed trust models (multi-signature, threshold cryptography) over single-key custody.

– Contract logic: pursue formal verification where feasible; ensure modular, upgradeable bridge components.

– Governance: implement clear upgrade processes with external reviews and time-locked changes.

2) Choose a pattern aligned with your risk tolerance

– For safer rails and BTC-first alignment, study trust-minimized designs similar to rootstock/BitVMX approaches, complemented by independent verification layers. (Look to Rootstock/Union for reference.)

– For broader reach with faster time-to-market, explore threshold-cryptography-based minting and gasless cross-chain minting where supported by target networks.

– If you connect many chains and partner ecosystems, consider a hub-and-spoke architecture with a transparent, auditable governance framework.

3) Build verification and auditability in from day one

– Plan formal verifications and third-party audits of bridge contracts and cross-chain handlers before mainnet deployment.

– Seek certifications or align with recognized standards (ISO 27001, SOC 2) where feasible to meet enterprise expectations and bolster user trust. Chainlink’s certification trajectory offers a useful reference point.

4) Invest in monitoring, forensics, and incident response

– Deploy real-time risk-detection capabilities and run regular tabletop exercises to validate incident response plans.

– Develop a provenance layer to trace cross-chain transfers for post-incident analysis and forensics.

5) Prepare for upgradeability and future-proofing

– Design upgrade processes that require multi-party governance and time delays to prevent rapid, unsafe changes.

– Begin exploring post-quantum considerations where practical today, without sacrificing current operability.

6) Concrete next steps you can implement this quarter

– Create a 4-layer risk map for your bridge design and identify the top-three mitigations per layer.

– Draft a governance blueprint with time-locked upgrades and third-party review gates.

– Initiate a formal verification plan and begin engaging a reputable auditor early in the development cycle.

– Set up a minimal real-time monitoring dashboard and run quarterly tabletop exercises with your security team.

Closing Message

The path to Bitcoin across chains that you can trust—and sleep beside—begins with architecture that proves safety every day, not just in theory. Your next design review could be the turning point where you move from hopeful ambition to demonstrable resilience. Start with a clear four-layer risk map, secure distributed custody where feasible, and a governance model that earns the confidence of users, auditors, and partners.

What guarantees beyond clever cryptography will you offer at day one—and how will you prove them year two? If you can articulate a credible safety net that scales with your ambitions, you’ll be part of a new era in BTC interoperability where trust is earned through meticulous design, transparent practices, and relentless verification. If this resonates, begin applying these principles in your next bridge project and share your learnings with the community.

“What would it take for BTC to travel across dozens of chains with auditable safety at scale?” The answer isn’t a single trick; it’s the ongoing practice of building, testing, and improving together.