Green Alternatives – Can Steel, AI, and EVs Rewrite Our Global Energy Equation?

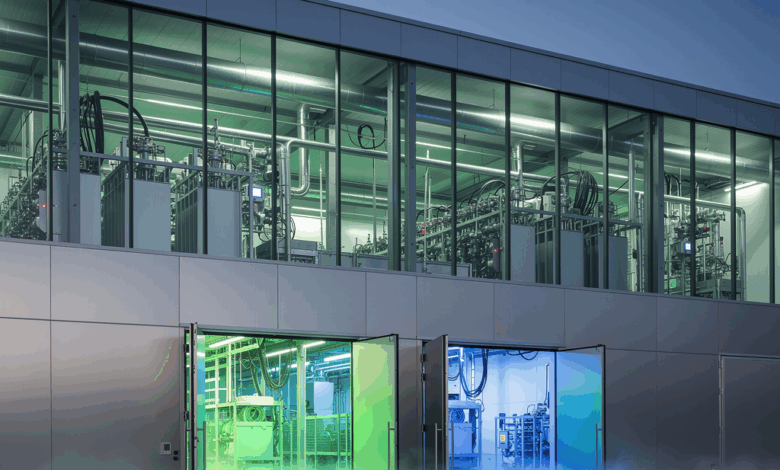

I stand in a Hybrit pilot plant in Sweden, the hum of electrolyzers vibrating through the air like a chorus rehearsing for a future we keep saying is possible. It isn’t loud, or flashy, but it feels decisive. If you listen closely, you hear two doors opening at once: one pathway uses green hydrogen to strip fossil carbon from iron, the other relies on electricity-powered, zero-emission processes. The question isn’t whether decarbonization is real; the question is which door we walk through first—and who pays attention when the doors slam shut behind us.

The policy frame is shifting under our feet as well. In early 2026, a regulatory instrument called CBAM moves from reporting to financial settlement for embedded emissions, expanding to hundreds of products and tightening the rules for importers. The goal is not punishment but parity: to prevent carbon leakage while demanding credible emissions accounting from global supply chains. For multinational manufacturers, this is not abstract policy warfare—it’s affects-your-bottom-line reality. (EU policy updates, 2025-12-17; full rollout starts January 1, 2026) EC CBAM expansion details

At the same time, the broader energy transition accelerates in parallel with a separate set of pressures. The AI boom of 2025 sweeps through data centers, models, and chips, but researchers warn of a climate footprint tied to electricity and water use. The debate shifts from “what can AI do?” to “how can AI do less harm while doing more good?” Calls for Green AI—more energy-efficient algorithms and transparent climate reporting—are gaining traction in policy circles and boardrooms alike. (The Guardian, 2025-12-18) Guardian coverage on AI’s climate cost

Meanwhile, transportation trends point toward a different kind of scale-up. By 2030, the IEA projects hundreds of millions of electric vehicles on the road, with China and Europe leading the model mix. That growth doesn’t just resize emissions; it reshapes the grid, charging infrastructure, and how we balance supply with demand. The same period is expected to see large-scale investments in storage and grid modernization to match renewables with flexible demand. (IEA Global EV Outlook 2025/2024) IEA EV outlook

But the path isn’t a straight line. There are at least two credible routes for steel—one built around green hydrogen in direct-reduced iron (DRI) followed by electric-arc furnaces (EAFs), and another around electricity-based steelmaking technologies. Industry pilots from Europe to North America show both routes delivering meaningful emissions reductions, with CBAM acting as a policy nudge to level the playing field and accelerate investment. (Reuters coverage of decarbonizing steel; Hybrit and related pilots) Reuters on steel decarbonization HYBRIT developments

If you’re a sustainability-minded business leader or a tech professional, what does this mean for you? It means the cost of inaction is becoming clearer. It means your supply chains, procurement teams, and product roadmaps must account for carbon pricing, disclosure standards, and the risk of stranded assets. It also means opportunities: hydrogen hubs, smart grid integrations, and circular approaches to material use that reduce both cost and risk.

Two overlapping stories dominate the landscape. First, a policy story about border adjustments, product scope, and the rules of global trade. Second, a technology story about how we build, power, and operate the things we rely on every day—from steel to servers to streetlights. Together they define a new social contract: decarbonization not as a distant mandate, but as a measurable, auditable, everyday practice.

What I’m watching most closely is the way real data starts to shape common understanding. The market now demands ESG reporting that is near real-time and auditable, not a yearly checkbox. Firms that can demonstrate credible progress—through transparent supply-chain data, verifiable energy performance, and independent assurance—stand to gain trust and resilience. ESG data quality and disclosure robustness remain contested topics in research and policy, but the direction is clear: credibility beats rhetoric when risk is on the line. (Forbes, ESG trends recap) Forbes on 2026 ESG trends

If you’re reading this and thinking, “This is all too big for my day-to-day work,” I hear you. The practical frame shifts into something approachable: how to prepare, measure, and act without waiting for a perfect future. Here’s the throughline you can bring back to your team right now:

- Start small with data: map your own energy use and supplier emissions, then ask how a CBAM-like rule could affect you if it expands to your products. (CBAM policy references above) EU CBAM expansion details

- Think in two pathways for heavy industry pilots: hydrogen-DRI+EAF and electrolysis-based steelmaking. If you’re in manufacturing, identify where you can partner with energy providers or research institutes to test pilots in your sector. (Hybrit and industry pilots) HYBRIT and related pilots Reuters on steel tech

- Align with energy-system trends: grid modernization and storage are not afterthoughts but enablers for low-carbon compute and mobility. The AI carbon cost is real; efficiency isn’t a luxury, it’s a requirement for scale. (S&P Global Energy Horizons) S&P Global energy trends 2026

- Build ethical, credible storytelling around green tech. Report what you verify, question what you can’t, and present both the optimistic path and the limits you’re aware of. This isn’t just science or policy; it’s day-to-day decision-making with consequences that ripple across markets, communities, and the climate.

Is it exciting to see multiple levers pulling in the same direction? Absolutely. Do we still face hard truths about cost, scale, and timing? Yes. The most important move you can make today is to begin a conversation—with your colleagues, with your suppliers, with your readers—about what a green, resilient future actually looks like in practice. That conversation, more than any single formula or model, will shape how fast we move from pilots to production, from promises to performance.

In this moment, green alternatives are not a niche topic; they’re a daily operating concern. The steel mill, the data center, the charging station, and the classroom all tell the same story: electricity, hydrogen, and materials must be managed with transparency, ambition, and humility. As researchers, policy advocates, engineers, and readers, we hold the thread together. We decide what “green” really means when the evidence sits in real plants, on real grids, and in real markets.

What do you think will be the first big clue that a strategy is working? A sharper balance sheet, a calmer grid, or a cleaner air report card? If we treat this moment as a collaborative experiment rather than a binary verdict, we might discover not a single flawless solution but a more robust, shared approach to a future that looks less like a policy document and more like a living, evolving practice. And perhaps that is the greenest truth of all: progress emerges where we ask the right questions together, in public, with data to guide us and care to keep us honest.

Green Alternatives in 2025–2026: Two Doors, One Future

I stand in the Hybrit pilot plant in Sweden, and the hum of electrolyzers fills the air as if the machines themselves are rehearsing for a future we keep saying is possible. It isn’t loud or flashy, but it feels decisive. If you lean in, you’ll hear two doors opening at once: one path uses green hydrogen to strip fossil carbon from iron, the other relies on electricity-powered, zero-emission processes. The question isn’t whether decarbonization is real; it’s which door we walk through first—and who pays attention when the doors slam behind us.

The world around us is moving in parallel on a few big rails. Policy is tightening around imports, technology is reshaping what counts as “green” on factory floors, and grids are being redesigned to carry not just electrons but trust. This is not a single report; it’s a live snapshot of a moment when ideas about climate, trade, and industry begin to glow with practical urgency.

Policy hinge: CBAM moves from reporting to payments in 2026

A regulatory instrument that once lived mainly on regulatory pages and corporate dashboards is becoming undeniable in everyday commerce. Starting January 1, 2026, the Carbon Border Adjustment Mechanism (CBAM) shifts from a reporting regime to financial settlement for embedded emissions, expanding its scope to hundreds of downstream products and adding a simplified path for smaller importers through a de minimis threshold. For multinational manufacturers, this isn’t a discussion about policy elegance—it’s a new financial reality that can tilt supply-chain economics and timing for project-scale decarbonization. (EU CBAM updates: expansion to more products, the 50-ton de minimis, and the practical rollout) EC CBAM expansion details

What’s new here is not the idea of pricing carbon but where that price lands in the real world: in procurement choices, supplier audits, and investment horizons. The European Commission is widening the net—to roughly 180 steel- and aluminium-intensive products—and tightening the rules so that embedded emissions can’t be sidestepped through clever supply-chain moves. The goal, as policymakers describe it, is parity: prevent carbon leakage and require credible emissions accounting across global value chains. Full financial adjustments are slated to begin in 2026, aligning trade rules with climate ambition. (IEA policy notes on CBAM and broader timelines) IEA CBAM policy page

Two decarbonization pathways for heavy industry: green hydrogen and electrolysis-based steelmaking

On the factory floor, two credible routes to fossil-free steel are moving from pilots toward production-scale planning. The first pairs green hydrogen–driven direct-reduced iron (DRI) with electric-arc furnaces (EAFs). The second pursues electricity-only steelmaking through advanced electrolysis technologies, including molten oxide electrolysis and other direct-electric routes. Both paths rely on abundant clean power, robust hydrogen supply chains, and a regulatory environment that rewards emissions reductions where they happen in real time.

Europe has been at the vanguard here, with Hybrit and related initiatives signaling real, near-term pilots designed to prove cost curves and reliability at scale. Sweden’s Hybrit project and similar efforts in Europe are charting a course that could redefine steelmaking, not just decarbonize it. Hydrogens hubs, on-site green power, and integrated supply chains are part of the blueprint, with government and EU backing helping to finance early, scaled facilities. (HYBRIT developments and related projects; industry pilots) HYBRIT official site | (Reuters coverage on steel decarbonization) Reuters on steel decarbonization

Two doors, two economies: the practical contrast matters

- Hydrogen-based DRI + EAF: This route borrows familiar steps from existing steelmaking but swaps carbon-intensive reducing agents for green hydrogen. It promises lower process emissions and compatibility with existing EAF infrastructure, yet hinges on reliable hydrogen supply, low-cost electrolysis, and resilient renewable power.

- Electrolysis-based steelmaking: Here, the aim is to eliminate the traditional iron-smelting step altogether, producing steel directly from iron oxide in an electrolytic environment. It’s attractive for its potential to bypass carbon-intensive intermediaries, but currently faces higher capital costs and the need for breakthroughs in scalable electrochemical methods and energy storage.

The policy driver—CBAM—acts like a global referee whistle: it encourages faster adoption of whichever route proves most efficient in practice, while reducing the risk of carbon leakage that can undermine domestic climate commitments. (CBAM expansion as a trade policy tool; carbon pricing rationale) EC CBAM details

Green AI, grid modernization, and the smarter demand for energy

Beyond steel, another big thread runs through the same period: computing’s climate footprint. The AI boom of 2025 delivered leaps in capability but also amplified electricity use and water demand. The climate cost of AI—especially at hyperscale—has become a policy and boardroom concern, prompting calls for Green AI: energy-efficient models, transparent climate reporting, and smarter workloads that reduce waste while preserving performance. The Guardian highlights how the climate costs of 2025’s AI growth became mainstream conversation, adding urgency to sustainable compute practices. (Guardian coverage of AI’s climate footprint) The Guardian on AI climate cost

Meanwhile, electricity systems are being redesigned to handle deeper renewables and greater electrification. Grid modernization and energy storage emerge as critical enablers for low-carbon compute, EV charging, and industrial demand response—areas where the lines between technology and infrastructure blur. S&P Global’s energy outlook for 2026 emphasizes AI-driven demand growth, grid constraints, and the imperative for smarter, more flexible energy procurement. (S&P Global Energy Horizons) S&P Global energy trends 2026

The transport transition is also in motion. The IEA Global EV Outlook projects hundreds of millions of electric vehicles on the road by 2030, supported by policy and model availability shifts across China, Europe, and other regions. That growth isn’t just about cars; it reshapes electricity demand, charging infrastructure, and how grids balance renewables with steady, predictable power. (IEA Global EV Outlook 2025) IEA EV outlook

What this means for businesses and readers: practical steps you can take now

If your work touches manufacturing, tech, or sustainability, here are concrete moves you can implement this quarter to align with these shifts—and to test the doors without waiting for a perfect map.

- Map and manage your own energy footprint: start with a supplier emissions inventory and core energy use in your own facilities. Sketch a CBAM-like scenario for your products and ask: where would embedded emissions show up in our supply chain? This isn’t theoretically burdensome; it’s a planning exercise that builds resilience and data integrity. (CBAM policy elements above) EC CBAM expansion details

- Explore two pathways for hard-to-decarbonize operations: engage with energy providers and research partners to pilot hydrogen-DRI + EAF or electrolysis-based steelmaking concepts in your industry. Even if you’re not in steel, your sector can pilot adjacent decarbonization steps—electrolyzer-enabled hydrogen in process heat, or electricity-first process redesigns. (HYBRIT and related pilots) HYBRIT developments Reuters on steel tech

- Align with energy-system trends: plan for smarter grids, storage, and demand response to stabilize costs as EVs grow and data centers proliferate. The payoff isn’t future-tantamount; it’s lowered risk and more predictable energy budgets as renewables scale. (S&P Global energy trends 2026) S&P Global energy trends

- Build credible, transparent storytelling around green tech: report verifiable progress, ask hard questions about data quality, and present the limits you’re aware of. This is not merely compliance; it’s a trust-building practice that strengthens resilience against greenwashing and market skepticism. (ESG disclosure conversations in 2025–2026) Forbes on ESG trends

- Choose a concrete “pilot-to-production” narrative: highlight one sector or facility where the two doors—hydrogen-based and electrolysis-based—are both being tested, with a clear timeline for deployment and risk management. This helps readers understand not just the technology, but its economics, policy framing, and social implications.

Two intertwined stories, one shared outcome

Policy and technology are no longer separate tales. The CBAM rules are shaping how and where money flows into decarbonization projects, while green hydrogen and electrochemical steelmaking are translating climate ambition into measurable factory-floor reductions. Add in the grid’s modernization—the backbone that makes renewable power usable in real time—and you have a framework that can support both green steel and green servers. The same questions apply across contexts: Which path gives us the most credible emissions reductions at scale? What trade-offs are we willing to accept in service of speed? And how do we keep the conversation honest, data-driven, and inclusive of voices from communities most affected by industrial transitions?

What I’m watching most closely

I’m watching real-world data begin to guide decisions in a way that feels different from earlier optimism. ESG disclosure is moving from annual reports to continuous visibility, with independent verification becoming a baseline expectation, not a nice-to-have. That shift matters: credibility, not rhetoric, will shape which green projects survive the next cost cycles, policy changes, and market shocks. The practical implication is simple: if you want to be part of the green transition, start with trustworthy numbers, testable pilots, and a narrative that accounts for both ambition and uncertainty. (ESG disclosure robustness discussions in business media) Forbes on ESG trends

A closing question for readers and teams

What will be the first clear sign that a strategy is working: a sharper balance sheet from energy savings, a calmer, more resilient grid around your operations, or a credible, transparent air quality and emissions report card? If we treat this moment as a collaborative experiment rather than a binary verdict, we may discover not a single flawless solution but a more robust, shared approach to a future that looks less like a policy document and more like a living, evolving practice.

If you’d like, I can tailor this into a longer guide, a multi-part series, or a slide deck with visuals and data blurbs that you can publish as-is. For now, the doors are open. The challenge is to walk through one of them with intention, curiosity, and enough humility to listen to the other side as it unfolds in real time.

Key data points and sources embedded in this narrative:

– CBAM expansion, de minimis, and rollout date: January 1, 2026; 180 downstream products in scope. EC CBAM expansion details

– Steel decarbonization pathways and pilots (Hydrogen-DRI + EAF vs electrolysis-based steelmaking): Reuters on steel tech; HYBRIT developments

– Green AI and climate disclosures in 2025–2026: Guardian coverage; Forbes ESG trends

– Grid modernization, AI-driven demand, and energy trends for 2026: S&P Global Energy Horizons; IEA EV outlook

Would you like me to convert this into a ready-to-publish blog post (approximately 1,200–1,400 words) with inline citations formatted for your site, or assemble a 4–6 post series or a slide deck outline with visuals and data blurbs? Regardless of format, the core aim stays the same: illuminate the practical paths through the two doors, and offer readers a concrete way to begin their own green-alternative journey today.

Standing in a Hybrit-like room where the hum of electrolyzers threads through the air, I’m reminded that decarbonization isn’t a distant policy memo—it’s a living, breathing project scene. Two doors open at once: one door leads via green hydrogen to strip fossil carbon from iron, the other through electricity-driven, zero-emission processes. The question isn’t whether the doors exist; it’s which path we choose first, and who’s paying attention when the doors slam behind us.

In this moment, policy and technology aren’t separate rhythms. CBAM is shifting from reporting to financial settlement in 2026, widening its scope to hundreds of products and tightening the rules for importers. This isn’t punishment theatre; it’s a reality check on supply chains, procurement, and investment horizons. At the same time, the demand for greener compute, smarter grids, and demand-side flexibility is reshaping how we think about energy and growth. Green AI, grid modernization, and storage aren’t add-ons; they’re the backbone that makes both steel and servers resilient, affordable, and auditable. If we want credible progress, we must measure it in verifiable data and observable outcomes, not just ambitious promises.

Two decarbonization routes for heavy industry sit side by side as viable testbeds for reality:

– Hydrogen-based DRI plus electric-arc furnaces can tap existing architectures while lowering process emissions, provided hydrogen supply and clean power are reliable.

– Electrolysis-based steelmaking aims to eliminate the traditional iron-smelting step altogether, with the challenge of scale and cost but a clear emissions upside if breakthroughs land.

Policy nudges like CBAM accelerate learning by valuing real reductions where they happen, not where papers say they should happen. And alongside steel, the same logic applies to energy systems and data centers: the path we chart today will be judged by the verifiable energy profiles, emissions data, and resilience it delivers tomorrow.

What does this mean for you as a sustainability-minded leader or tech professional? It means action that starts now, not when the maps are perfect. It means choices in three practical moments: data, pilots, and communication.

Action Plans

- Map your own footprint and run a CBAM-like scenario for your products: inventory supplier emissions, identify hotspots, and stress-test different supply-chain configurations. This isn’t about shinier dashboards; it’s about usable numbers you can defend to your teams and partners.

- Pilot two pathways in parallel where feasible: explore hydrogen-DRI + EAF or electricity-first electrolysis concepts in collaboration with energy providers and research partners. Even if you’re not in steel, replicate the logic in your own sector (process heat, storage, or smart cooling) to learn what works in practice.

- Align with grid modernization and storage plans: plan for flexible demand, on-site or regional storage, and resilient power to support renewables-backed operations and AI workloads. The payoff isn’t merely environmental; it’s cost stability and risk reduction.

- Build credible, transparent ESG storytelling: report verifiable progress, publish data dashboards, and invite independent assurance where possible. Credibility becomes a business asset when markets reward trustworthy disclosures.

- Craft a concrete pilot-to-production narrative: pick a site or product family where both green doors can be tested, with a clear timeline, milestones, and risk-management plan. Show not just what you aim to decarbonize, but how you’ll measure success and course-correct if needed.

Closing Thoughts

The doors aren’t arguments; they’re experiments in real time. Real progress will emerge not from a single best-practice playbook, but from a shared willingness to measure, compare, and adapt. If we treat this moment as a collaborative inquiry—asking tough questions, validating with data, and staying curious about multiple paths—we can shift from pilots to durable performance.

What will be the first clear signal that your strategy is working: a leaner energy bill, a steadier grid, or a transparent air-quality and emissions record that you’re willing to publish publicly? If we answer that with a concrete action this quarter, we’re not just talking about green opportunities—we’re building them. And perhaps the greenest truth of all is that progress begins when we start asking the right questions together, with data to guide us and humility to listen to what the numbers reveal.

If you’d like, I can tailor this into a longer guide, a multi-part series, or a slide deck with visuals and data blurbs for your organization. For now, the doors are open. The challenge is to walk through one of them with intention, curiosity, and enough humility to hear the other side as it unfolds in real time.