The Rising Green Pulse in Bitcoin Mining – A New Energy Era

Why does a digital ledger care about the color of the electricity powering it?

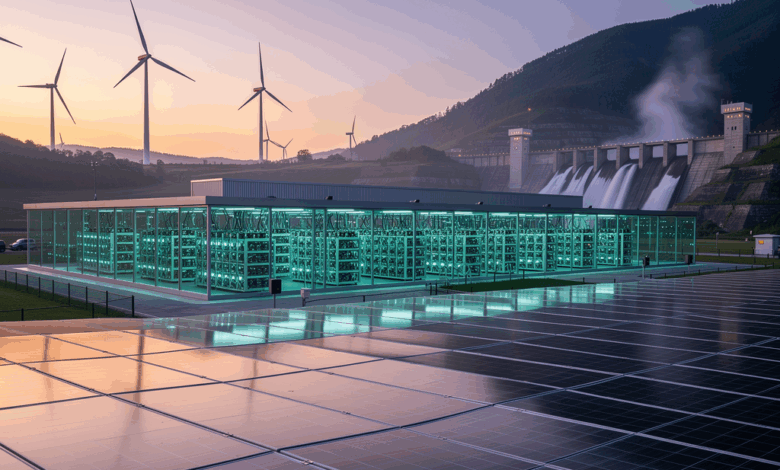

That question sits at the heart of a powerful shift in Bitcoin mining. A large-scale energy question is quietly rewriting the narrative: as of 2025, the energy behind the network is becoming greener, not merely cheaper. The Cambridge Digital Mining Industry Report (April 28, 2025) reveals a turning point: sustainable energy accounts for 52.4% of Bitcoin mining power, with renewables at 42.6% and nuclear at 9.8%. In practical terms, this isn’t a minor tweak in a power mix—it’s a structural pivot that tightens the link between mining activity and energy policy, grid economics, and regional development. And the most striking part? North America dominates this shift, with the United States alone contributing about three-quarters of reported sustainable mining activity, while Canada adds roughly 7%. Cambridge study.

But then something strange happened

What looks like a niche corner of the internet—cryptocurrency mining—is beginning to map onto the real-world grid in material ways. While the green share climbs, total energy use remains a topic of debate. Cambridge estimates Bitcoin mining consumes roughly 138 TWh annually (based on the surveyed 48% of the network), equating to about 0.5% of global electricity use. Those numbers aren’t just headlines; they interact with energy markets, policy debates, and the economics of appetite and flexibility on the grid. The survey covers about 268 EH/s, which translates to nearly half of the Bitcoin network’s hashrate at the time. If you care about electricity markets, climate policy, or the resilience of local grids, this is a conversation you’ll want to follow closely.

From power mix to everyday life: why this matters now

If you’ve wondered why crypto discourse sometimes feels distant from your daily life, this trend brings the discussion home. The shift toward lower-carbon power hubs—largely concentrated in North America—has tangible effects on energy prices, incentives for renewables, and the pace at which new mine facilities can be sited and operated. For energy managers and policymakers, the trend points to a few critical implications:

– Grid planning: A growing share of mining loads can stabilize or destabilize local grids, depending on when miners run their operations and how they bid into markets.

– Policy levers: Incentives for renewables, access to cheap clean power, and carbon accounting become live tools for aligning mining economics with climate goals.

– Investment signals: The location and energy mix of mining operations influence project finance, corporate strategy, and risk assessment for both energy and crypto portfolios.

Recent observations suggest a broader opportunity: if miners and grid operators collaborate on demand-response and long-duration storage, Bitcoin mining could become a flexible, value-adding participant in energy systems rather than a stubborn corner of demand. The data paints a picture of a decentralized activity gradually threading itself into regional energy economies, with measurable consequences for decarbonization timelines and regional growth.

From another angle a reader’s practical take

You don’t need to be a miner to feel the effects. Here’s how this trend touches everyday life:

– If you’re an energy consumer in a mining-dense region, you might see shifts in power pricing and reliability tied to when mining activity scales up or down in response to energy markets.

– If you’re a policymaker, the numbers offer a real-world case study in deploying clean-energy incentives and balancing reliability against growth.

– If you’re an investor or professional, the trend reframes risk: locations with abundant, low-carbon energy and favorable policy frameworks could become magnets for future mining capacity.

Is this sustainable, and what could come next?

Sustainability isn’t a verdict yet; it’s a trajectory. The Cambridge data illuminate a decarbonizing direction but also spotlight ongoing debates about absolute energy use and its relation to global electricity demand. The picture is nuanced:

– The share of sustainable energy powering mining has grown, but total energy draw remains sizable and connected to broader grid dynamics.

– Geography matters: North America’s leadership in sustainable mining is not a universal trend yet; regional mix and policy environments will shape future outcomes.

– The interaction with policy will determine whether the trend accelerates or plateaus, and how miners respond with efficiency, geographic diversification, or technology upgrades.

What you can do in light of this trend

- Stay informed: monitor credible reports on energy mix and policy changes in regions hosting significant mining activity.

- Consider collaboration: if you’re involved in energy planning, seek dialogue with mining operators to explore demand-response, renewable sourcing, and shared storage solutions.

- Think strategically: for financial or operational planning, factor in potential shifts in energy prices, carbon costs, and grid reliability as mining activity and green energy investments evolve together.

Value and invitation

This trend isn’t just about numbers on a page; it’s about how electricity, policy, and digital economies intersect in real time. The current data suggest a world where Bitcoin mining is becoming more aligned with the grid’s long-term goals, not in spite of them. If we can sustain this alignment, what new opportunities might unlock for energy systems, local communities, and the people who rely on reliable power every day?

What’s your take on this shift—could cleaner energy-and-mining partnerships become a new norm in your region, and what would that mean for your life?

What if the glow of a monitor at 3 a.m. in a quiet town could tell us something bigger about our power grid, our policies, and the future of money? I remember a late-night conversation I once had in a roadside diner with a group of miners who weren’t looking to debate Bitcoin as much as they were bargaining with the night’s electricity prices. They spoke in terms of temperature and kilowatts, of demand curves, and the art of turning a fluctuating energy market into predictable, economic fire. That night became my entry point into a question I kept circleing back to: what does it mean when a digital ledger depends on a very real, very physical thing—electricity—and how is that electricity changing as we chase a cleaner grid and a more resilient energy system? This is not a tale of booms and busts, but a story about the color of power and how it colors the future of mining, policy, and everyday life.

How the energy behind Bitcoin is changing its story

The newest data points aren’t flashy headlines about record hash rates or market caps; they’re about the energy mix fueling the network. As of December 14, 2025, a landmark Cambridge Digital Mining Industry Report (April 28, 2025) shows a meaningful decarbonization pivot: sustainable energy accounts for 52.4% of Bitcoin mining power, with renewables at 42.6% and nuclear at 9.8%. In practical terms, this isn’t a marginal tweak. It signals a structural shift where mining activity increasingly sits at the intersection of energy policy, grid economics, and regional development. And the geography of this shift matters greatly: North America is where the action is most concentrated—about three-quarters of reported sustainable mining activity in the United States, with Canada around 7%. These shares aren’t just a stat sheet; they map onto how grids are planned, how energy markets are priced, and how new mining facilities are sited.

- A broader energy footprint for mining exists, but the mix is changing. The same Cambridge snapshot estimates total Bitcoin mining energy use at roughly 138 TWh per year, considering about 48% of the network in their sample. That translates to about 0.5% of global electricity use. The numbers aren’t just about scale; they frame policy discussions and reveal how mining interacts with electricity markets, reliability, and the economics of grid flexibility. The surveyed firms account for about 268 exahashes per second (EH/s), roughly half of the Bitcoin network’s hashrate at the time of data collection. If you care about energy policy or the economics of large-scale electricity consumers, these figures become living data—signals you can watch as grids adapt to new kinds of demand.

Why the color of electricity matters for the mining story

If you’ve wondered why crypto debates sometimes feel distant from your day-to-day life, this trend brings the electricity debate home. The shift toward lower-carbon power hubs isn’t just about making the ledger greener; it affects grid stability, local economies, and the pace at which new energy projects can be powered by industrial demand.

What does this mean in concrete terms for three key groups?

- energy managers and grid operators: the presence of a flexible, sizable cooling load like mining can act as a stabilizing or destabilizing force depending on when miners run and how they bid into energy markets. Demand-response, long-duration storage, and incentives for renewable sourcing become not just nice-to-have options but essential tools for balancing reliability with growth.

- policymakers: the trend provides a live-case study in how clean-energy incentives, carbon accounting, and siting policies interact with digital-currency activities. The right policy levers could accelerate decarbonization while ensuring grid resilience and economic development in mining-heavy regions.

- investors and corporate strategists: location, energy mix, and policy environments can shift risk and opportunity. Regions with abundant, low-carbon power and clear policy pathways can attract more mining capacity, while those with high-carbon baselines or uncertain regulation may face slower or more volatile growth.

The practical implications what changes on the ground look like

Here’s how the numbers translate into real-world dynamics:

- Grid planning and investment: with mining loads increasingly tied to cleaner energy, grid planners must consider new patterns of demand and potential flexibility. This could mean aligning mining activity with times of excess renewable generation or lower marginal costs and building the infrastructure to move power where it’s most valuable.

- Policy design: carbon accounting, clean-energy incentives, and access to cheap, clean power will shape where mining can flourish. Policies that reward low-emission sourcing and encourage collaboration with grid operators can lower the perceived risk for miners and energy providers alike.

- Market signals for miners and energy companies: the trend highlights a longer horizon—where mining is not just a consumer of power but a potential partner in grid services, settlement strategies, and energy-market arbitrage. In other words, the relationship between Bitcoin mining and the energy system is evolving from a simple demand hook to a more integrated, value-generating interaction.

Case studies and concrete patterns (without naming brands, but with the flavor of real-world dynamics)

- Case 1: A mine sits near a wind-rich region where transmission constraints used to cap growth. By coordinating with the local grid operator, the facility negotiates a hybrid approach: operate at higher loads when wind is abundant and prices are low, and ramp down during peak demand periods or when carbon-intensive generation would otherwise fill the gap. This creates a form of demand-side flexibility that benefits the entire system and lowers costs for nearby consumers.

- Case 2: A coastal province with robust solar generation and a policy push toward renewables becomes a magnet for new facilities that pair mining with solar-plus-storage. The miners gain price stability, while operators add storage to smooth out intermittency, turning a previously volatile resource into a more predictable asset for the grid.

- Case 3: In a region historically reliant on natural gas, miners experiment with longer-duration storage and hybrid cooling systems to reduce curtailment and align with carbon-reduction goals. The result is a more efficient use of existing assets and a demonstration that mining can coexist with broader decarbonization efforts when paired with thoughtful planning.

These patterns aren’t about one-off anecdotes—they reflect a broader move toward a more synchronized energy-economy where the line between “miner” and “consumer of power” blurs in a productive, policy-relevant way.

What could come next? A forward-thinking view

The Cambridge data show a decarbonization trajectory, but the path isn’t fixed. Several forces could accelerate or slow this trend:

- technology and efficiency gains: improvements in mining hardware and energy-management software can reduce energy intensity and improve flexibility, pushing more operators toward low-carbon power sources.

- regional policy shifts: clearer rules around carbon accounting, power-purchase agreements, and grid access will influence where miners choose to locate and how they operate.

- market design for flexibility: as tools for demand response and storage mature, Bitcoin mining could become a more active participant in energy markets, offering capacity when it’s most valuable to the system and absorbing energy when it’s less scarce.

For energy managers, financial analysts, and crypto-industry professionals, the bottom line is not simply profitability. It’s about aligning mining activity with grid goals, benefiting communities, and ensuring that digital innovation does not outpace the ability of energy systems to absorb it cleanly and reliably.

A daily-life lens: turning trend into tangible impact

This isn’t only about corporate strategy or public policy. If you’re living in a mining-dense region, you may notice shifts in power pricing, reliability, or even local job opportunities tied to new energy infrastructure or workforce development. Policymakers might see stronger incentives to pair renewable build-out with industrial demand, shaping who gets to build, where, and under what terms. For investors and practitioners, the trend reframes risk: regions with dependable, low-carbon energy and supportive policy environments could become magnets for future mining capacity.

Questions to carry forward

Sustainability isn’t a verdict; it’s a trajectory. The current data illuminate a decarbonizing direction, yet energy use remains a live topic tied to broader electricity demand. The map repeatedly asks for careful interpretation: will total energy draw rise or fall as efficiency improves? Will geographic diversification dilute North America’s lead or extend it? How will policy evolve to encourage cleaner energy sourcing while maintaining reliability and growth?

What would it take to transform Bitcoin mining from a large-energy consumer into a measured partner that enhances grid resilience, accelerates renewables deployment, and supports local communities? And more personally: in your region, what arrangement between digital infrastructure and energy systems would make you feel the change is not just sustainable but also fair and beneficial to everyday life?

If we can nurture collaborations between miners and grid operators, if business models align with carbon goals, and if policy remains adaptable, this could be the moment when mining stops being a controversial afterthought and becomes part of a smarter, cleaner energy system.

What’s your take on this shift—could cleaner energy-and-mining partnerships become a new norm in your region, and what would that mean for your life?

—

Context and sources to explore further

– Cambridge Digital Mining Industry Report, April 28, 2025: highlights on sustainable energy share, renewables, and nuclear contributions to mining power, and the North American dominance in sustainable mining activity. Link: Cambridge study (provided via credible institutional channels).

– Policy discussions and grid-optimization research exploring demand-response, storage, and how flexible loads (like mining) intersect with renewable generation and carbon goals.

– Industry analyses on hash rate growth, energy-intensity trends, and regional siting dynamics in the context of energy policy and market design.

In sum, the current moment offers a rare glimpse of a digital economy deeply enmeshed with real-world energy systems. The question is not merely whether mining can be green, but whether it can be a constructive partner in the march toward reliable, affordable, and low-carbon power for everyone.

What would you want to see happen next in your region to feel that Bitcoin in Energy and Industry: Mining is moving toward a shared, sustainable future rather than a competitive demand spike? Share your thoughts, and let’s think this through together.

I’ll start with a memory from a late-night diner visit where the chatter wasn’t about coin, but current—the hum of the fridge, the glow of a dashboard, and the quiet bargaining of electricity prices as the wind howled outside. A miner, tired but wired with stubborn optimism, told me that the color of power mattered as much as the number on the bill: greener power meant steadier operations, and steadier operations meant a steadier future. That night, a simple question settled into my mind: why does a digital ledger care about the color of the electricity powering it? The answer isn’t just technical; it’s about trust, policy, and the evolving relationship between a global network and the grids that feed it.

What Cambridge’s latest snapshot makes clear is a real, measurable pivot: as of 2025, sustainable energy powers a majority of Bitcoin mining—52.4% overall—with renewables at 42.6% and nuclear at 9.8%. North America leads this shift, the United States alone accounting for roughly three-quarters of reported sustainable mining activity and Canada about 7%. It’s not a minor tweak in a power mix; it’s a structural shift that threads mining into energy policy, grid economics, and regional development. And the numbers matter not just for crypto folks, but for energy managers, policymakers, and investors watching how large loads reshape reliability, pricing, and investment risk.

From power mix to everyday life, the implications land where we live and work. If you care about energy markets or climate goals, this is no longer an abstract debate: it’s a live test of whether a high-energy digital industry can align with a grid that must serve billions of people and growing needs. The trend suggests three critical effects:

- Grid planning and reliability: mining loads can stabilize or complicate local grids depending on timing, capacity, and flexibility. The way miners bid into markets, and how grids coordinate demand response and storage, becomes a real tool for balancing supply and demand.

- Policy leverage: incentives for renewables, carbon accounting, and siting rules aren’t cosmetic tweaks; they’re mechanisms that can accelerate decarbonization while protecting reliability and regional development.

- Investment signals: where mining sits and how it sources power now informs project finance, corporate strategy, and risk management for both energy and crypto portfolios.

A broader opportunity is emerging: if miners and grid operators collaborate on demand response and long-duration storage, Bitcoin mining could become a flexible, value-additive participant in energy systems rather than a stubborn, single-directional demand spike. The data portray a decentralized activity gradually weaving into regional energy economies with tangible decarbonization and resilience implications.

So what does this mean for you, whichever side you stand on?

- Energy managers and grid operators: the presence of a sizable, flexible cooling load can be an asset or a liability. The path forward is to embed mining into grid services—demand response, renewable pairing, and storage solutions—so that the sector contributes to stability as it grows.

- Policymakers: use this as a live-case study for carbon accounting, clean-energy incentives, and siting policies that encourage clean sourcing while keeping grids robust and affordable.

- Investors and corporate strategists: regional energy mix, policy clarity, and the regulatory environment will shape risk and opportunity. Regions with abundant low-carbon energy and clear, supportive rules will become magnets for future capacity, while uncertainty can slow growth or shift it elsewhere.

What could come next is not predetermined. Technology and efficiency gains—advances in mining hardware and in energy-management software—could shrink energy intensity and boost flexibility, accelerating the shift toward low-carbon sources. Regionally, policy alignment will determine how fast this happens, whether miners double down on existing sites or expand to new locales with cleaner grids. And as demand-side tools mature, Bitcoin mining might transition from a passive consumer to an active partner in grid planning and energy-market design.

If you live in a mining-heavy region, you may already feel the ripple effects: changes in power pricing, reliability, and even local job opportunities tied to new energy infrastructure. If you’re a policymaker, you’re seeing the potential for a coordinated energy transition—one that pairs industrial demand with renewables and storage. If you’re an investor or a professional, the trend reframes risk and opportunity: the clean-energy arc can align with economic growth if managed with foresight and collaboration.

What can you do today?

- Stay informed: follow credible energy and crypto research for updates on energy mix, carbon accounting, and regulatory developments.

- Seek collaboration: if you influence energy planning, initiate conversations with mining operators about demand-response options, renewable sourcing, and shared storage strategies.

- Think strategically: factor in potential shifts in energy prices, carbon costs, and grid reliability as mining activity and green-energy investments evolve together.

This is not just about a numbers game on a page. It’s about how electricity, policy, and digital economies intersect in real time. The current trajectory points toward a future where Bitcoin mining aligns with grid goals, not in opposition to them. If this alignment can endure, it could unlock new opportunities for energy systems, local communities, and the people who rely on reliable power every day.

What’s your take on this shift—could cleaner energy-and-mining partnerships become the new norm in your region, and what would that mean for your life?

Extended reflection to carry forward: if the glow of a monitor at 3 a.m. in a quiet town could illuminate a broader grid story, what would that story say about our shared future—our money, our energy, and our responsibility to the planet and each other? I’ve learned that the color of power isn’t a mere detail; it’s a signal about accountability, opportunity, and the kind of future we choose to build together.

Looking ahead, the data point toward a decarbonizing direction, yet the total energy footprint remains a live question tied to broader electricity demand. If we nurture collaborations between miners and grid operators, and if policy keeps pace with innovation, this could be the moment when mining becomes a constructive partner in a smarter, cleaner energy system rather than a stubborn load to bear.

What next steps would you like to see in your region to move Bitcoin in Energy and Industry: Mining toward a shared, sustainable future? Share your thoughts, and let’s think this through together.